Economic Indicators

2025

3rd Quarter

Third quarter indicators continue a pattern of mixed results. There are positive indicators in the categories of bank assets, utility connections, and building permits. Real estate sales show mixed results, while bankruptcies are up and vehicle registrations are down compared to the same quarter in 2024.

2nd Quarter

The second quarter brought a mix of economic signals. Single-family home construction is moving in a positive direction, though home sales have slowed. Unemployment is up slightly and bank deposits are down, but there are bright spots with growth in bank assets, fewer bankruptcies, more vehicle registrations, increased building permit activity, and increases in most utility connections.

1st Quarter

First quarter indicators show positive trends in the categories of bank deposits, utility connections, single-family home construction and building permits. Real estate sales show mixed results, with number of sales up more than 50% compared to one year ago. Bankruptcies are up and vehicle registrations are down compared to the same quarter in 2024. The unemployment rate also ticked upward.

2024

4th Quarter

Fourth quarter indicators are positive in the areas of bank deposits, utility connections, new home construction and number of building permits issued. Residential real estate sales show downward trends, as do vehicle registrations. Bankruptcy numbers are also up from one year ago.

3rd Quarter

Third quarter indicators are varied, with bank deposits and assets growing, utility connections increasing, more vehicle registrations than a year ago, and strong labor force participation. Indicators are mixed in the areas of residential real estate sales and building permits.

2nd Quarter

Second quarter indicators show positive trends in all but two categories. Of note are the residential real estate indicators that are all positive, as well as single-family home construction and building permit numbers. Bank deposit numbers are positive as well. Bankruptcies and vehicle registrations are the only two categories not trending positively compared to one year ago.

1st Quarter

First quarter indicators show positive trends in the categories of bank deposits, utility connections, vehicle registrations, residential real estate sale prices, and new home construction. Bank deposits, residential property sales and building permit values are lower than they were one year ago.

2023

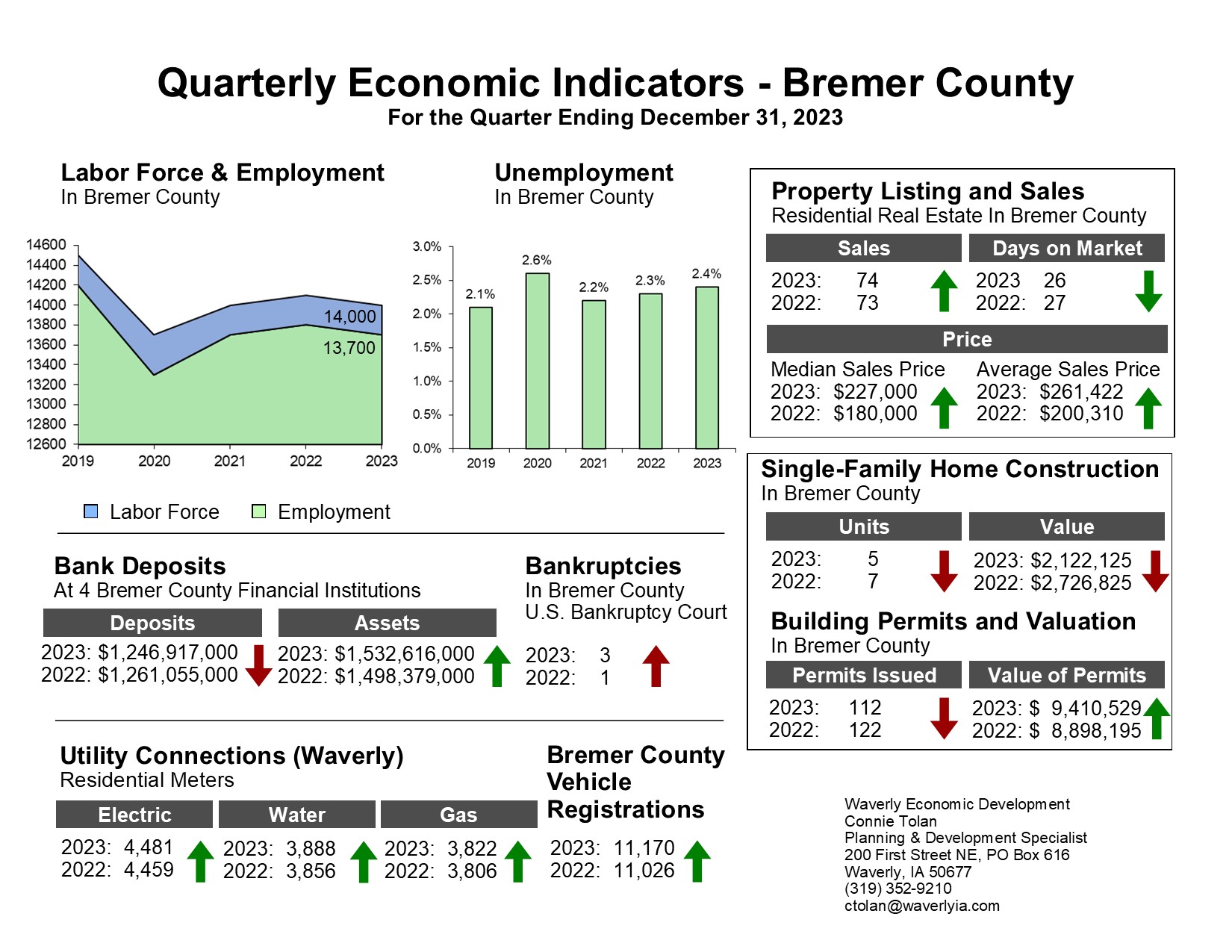

4th Quarter

Fourth quarter indicators are positive in the areas of bank assets, utility connections, vehicle registrations, building permit values and real estate sales. Bank deposits are lower than one year ago, as are single family new home construction permits.

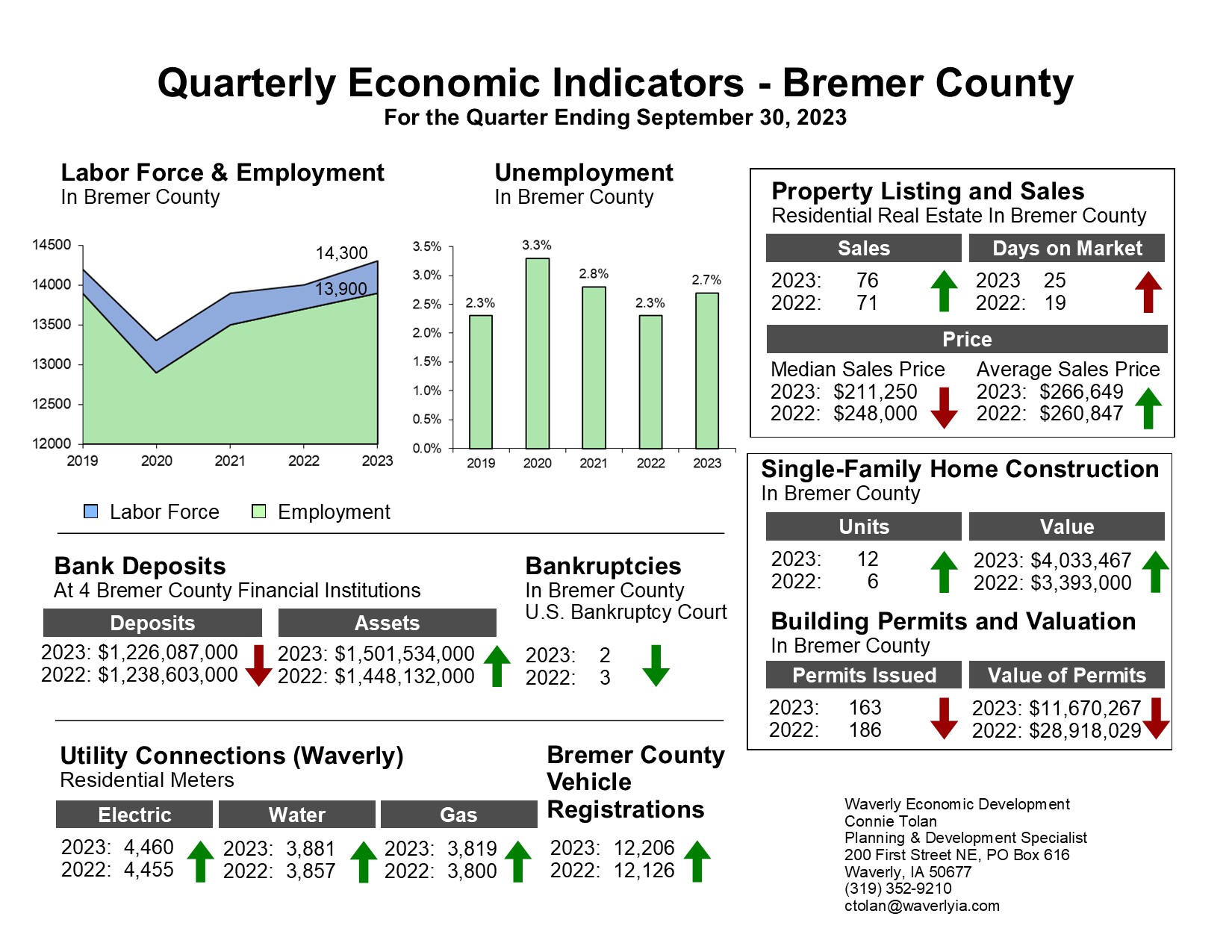

3rd Quarter

Third quarter indicators are mixed, as has been the trend. Positive indicators include growing bank assets, fewer bankruptcies, more homes sold, and twice as many single family new construction permits compared to the same period last year. It is notable that building permit valuations one year ago were bolstered by two large commercial projects.

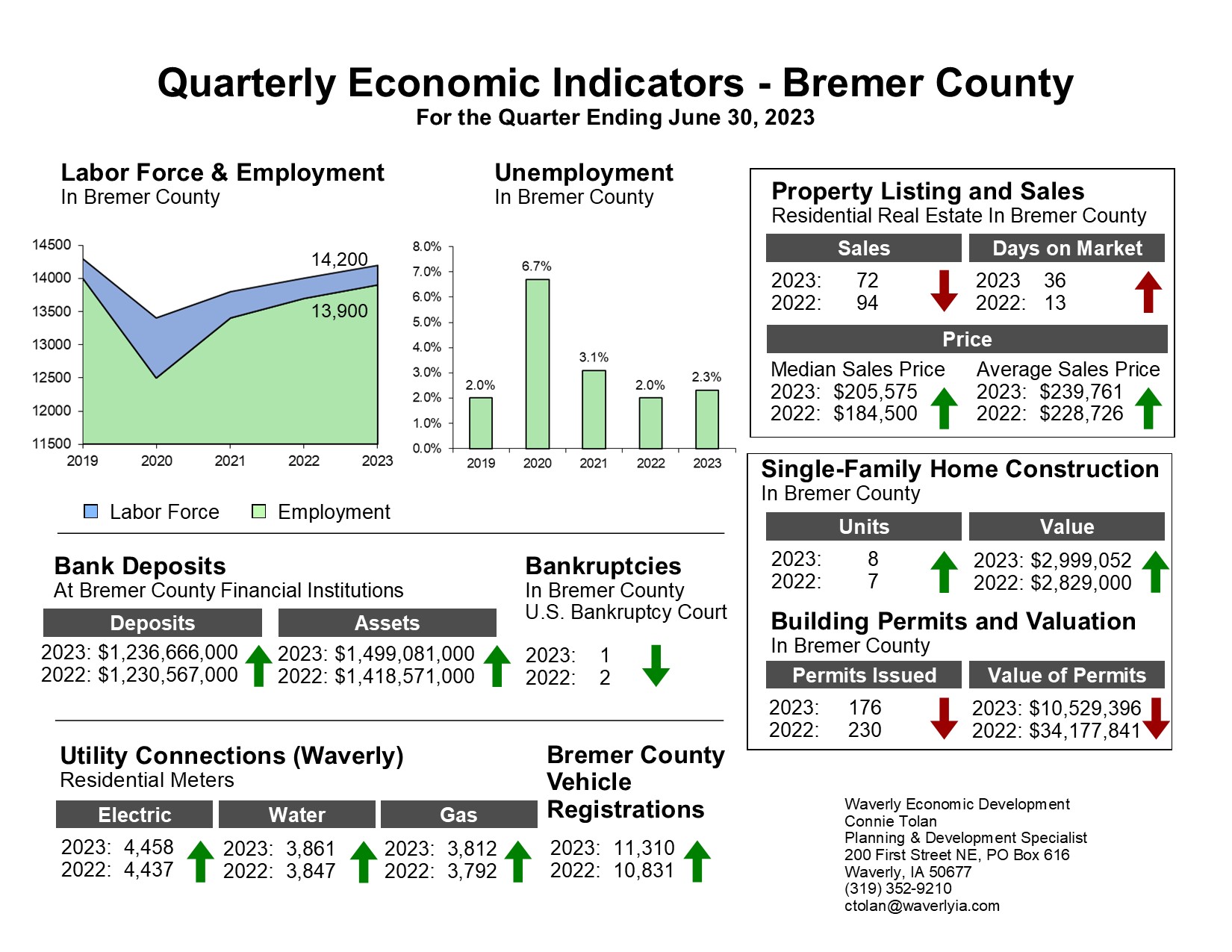

2nd Quarter

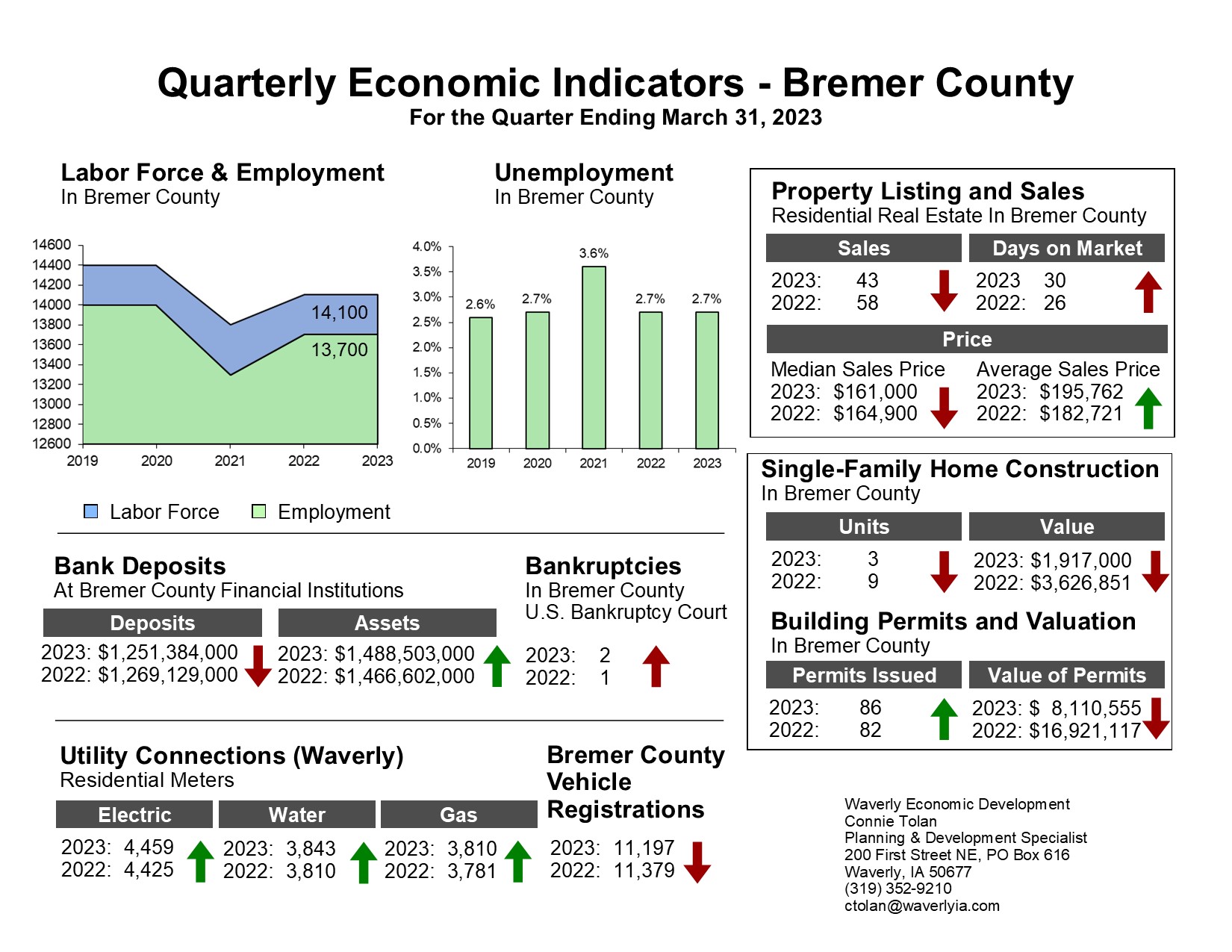

1st Quarter

2022

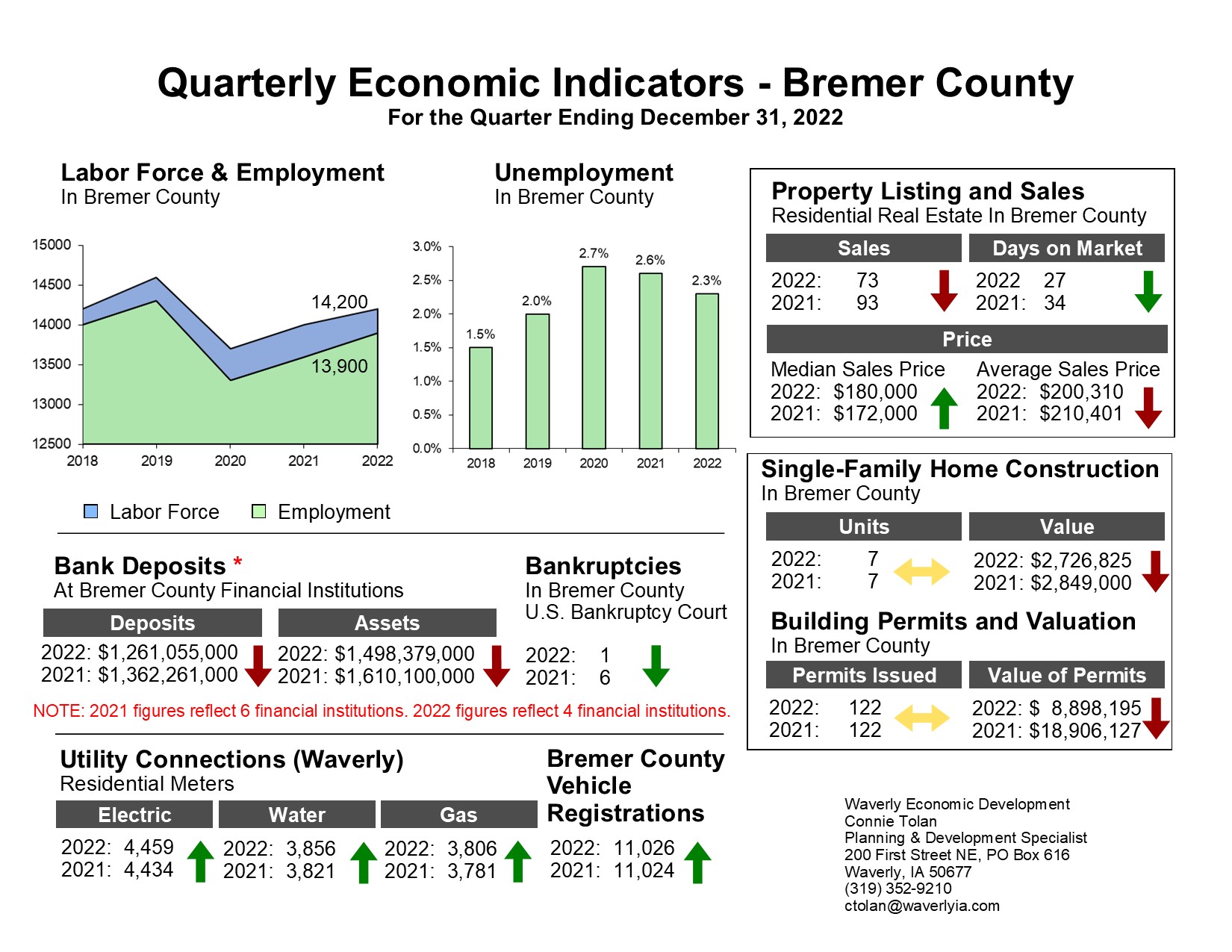

4th Quarter

Fourth quarter economic indicators are mixed, as they have been throughout much of 2022.

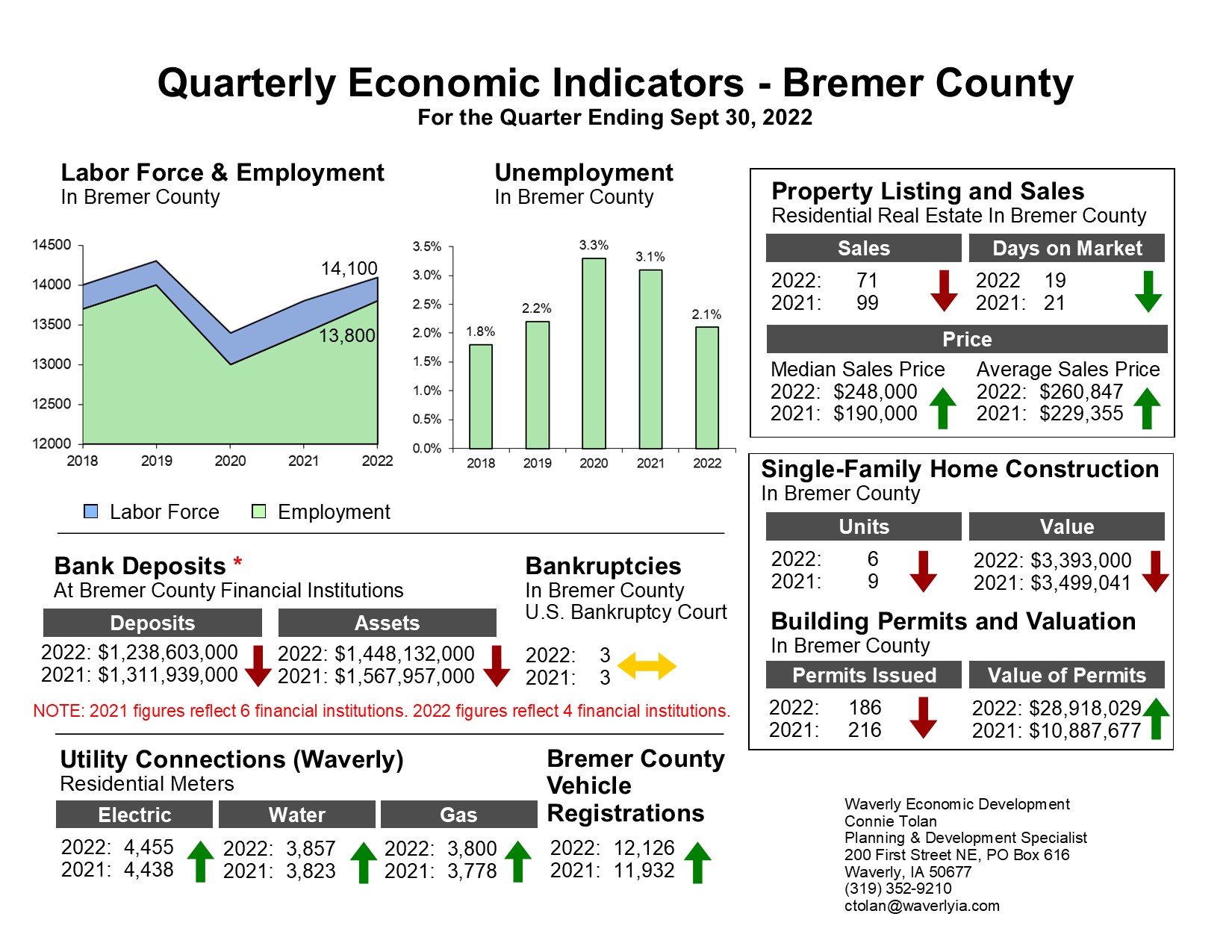

3rd Quarter

Third quarter economic indicators are showing trends much like the previous quarter. It is notable that building permit valuations were bolstered by significant commercial projects, and that bank consolidations resulted in skewed year-over-year bank deposit comparisons.

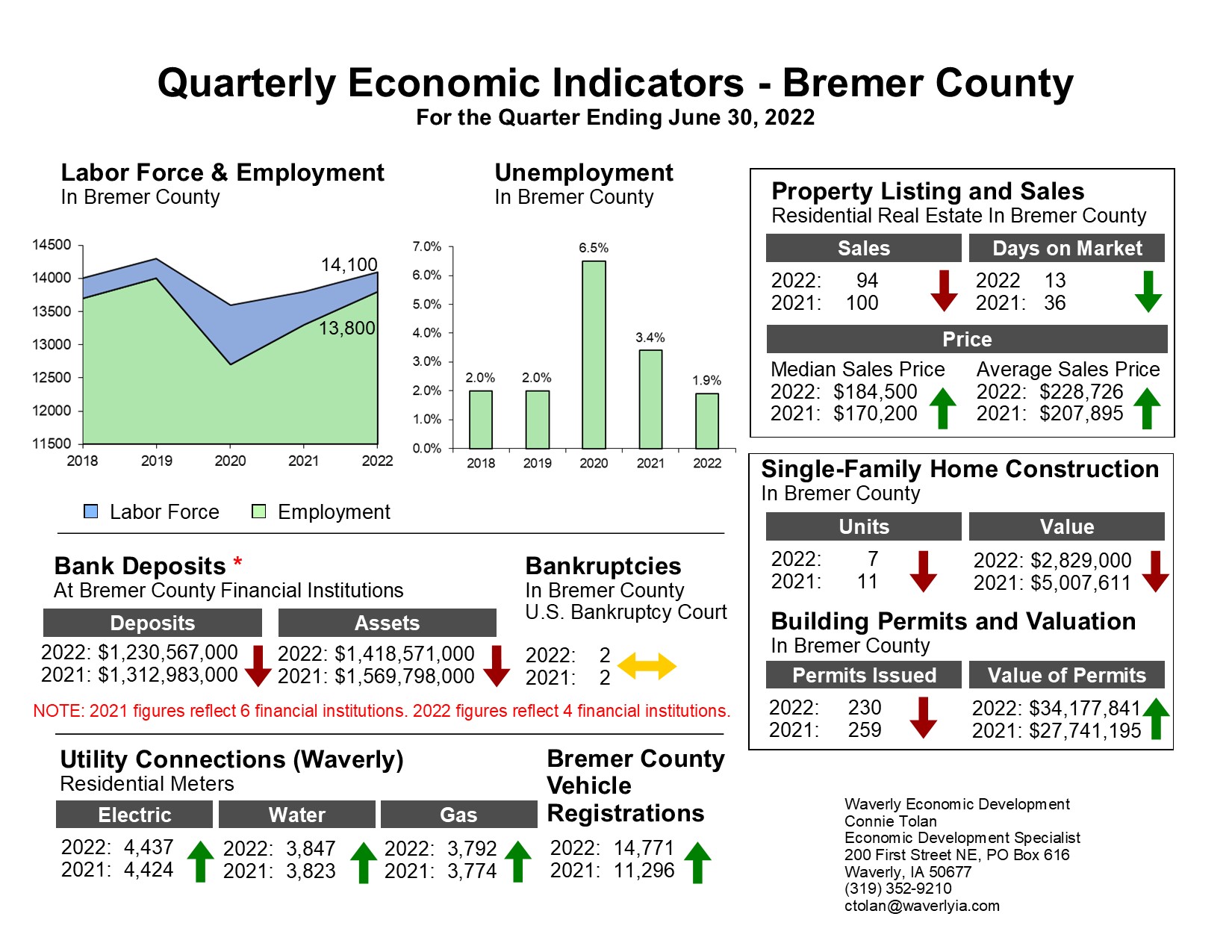

2nd Quarter

Second quarter economic indicators are trending very similarly to the prior quarter. Utility connections and vehicle registrations are up while unemployment remains low. Fewer homes were sold while days on market dropped and median and average sales price rose. Building permits show mixed results, with permit value bolstered by large commercial projects. Due to bank consolidations, there were 4 Bremer County institutions reporting in 2022 compared to 6 institutions in 2021, skewing those year-over-year comparisons.

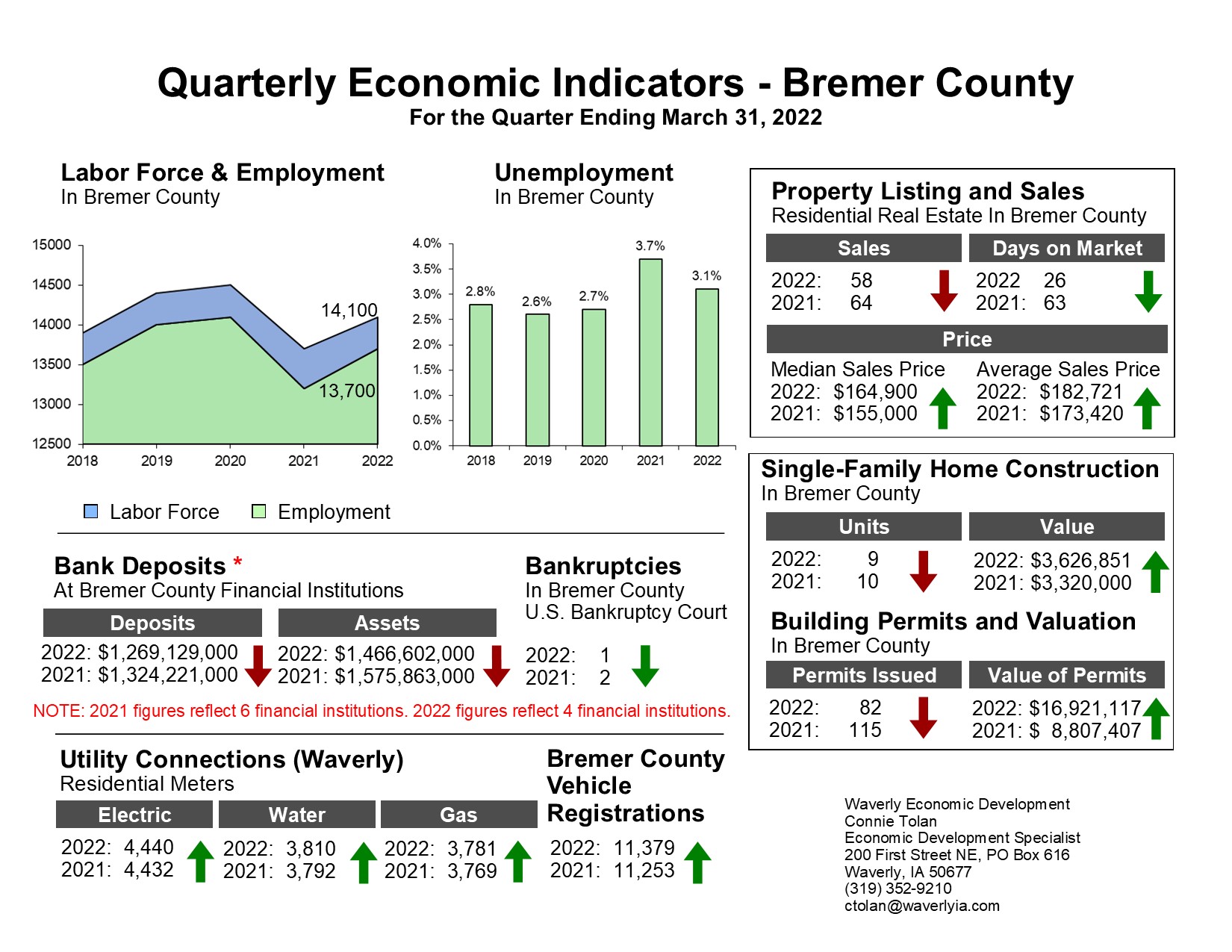

1st Quarter

First quarter economic indicators show strong employment participation, fewer bankruptcies, and positive trends in utility connections, vehicle registrations and bankruptcies. Fewer residential properties sold, but days on market decreased significantly and sales prices are up. Fewer building permits were issued, while valuations were higher. Due to bank consolidations, there were 4 Bremer County institutions reporting in 2022 compared to 6 institutions in 2021, skewing those year-over-year comparisons.

2021

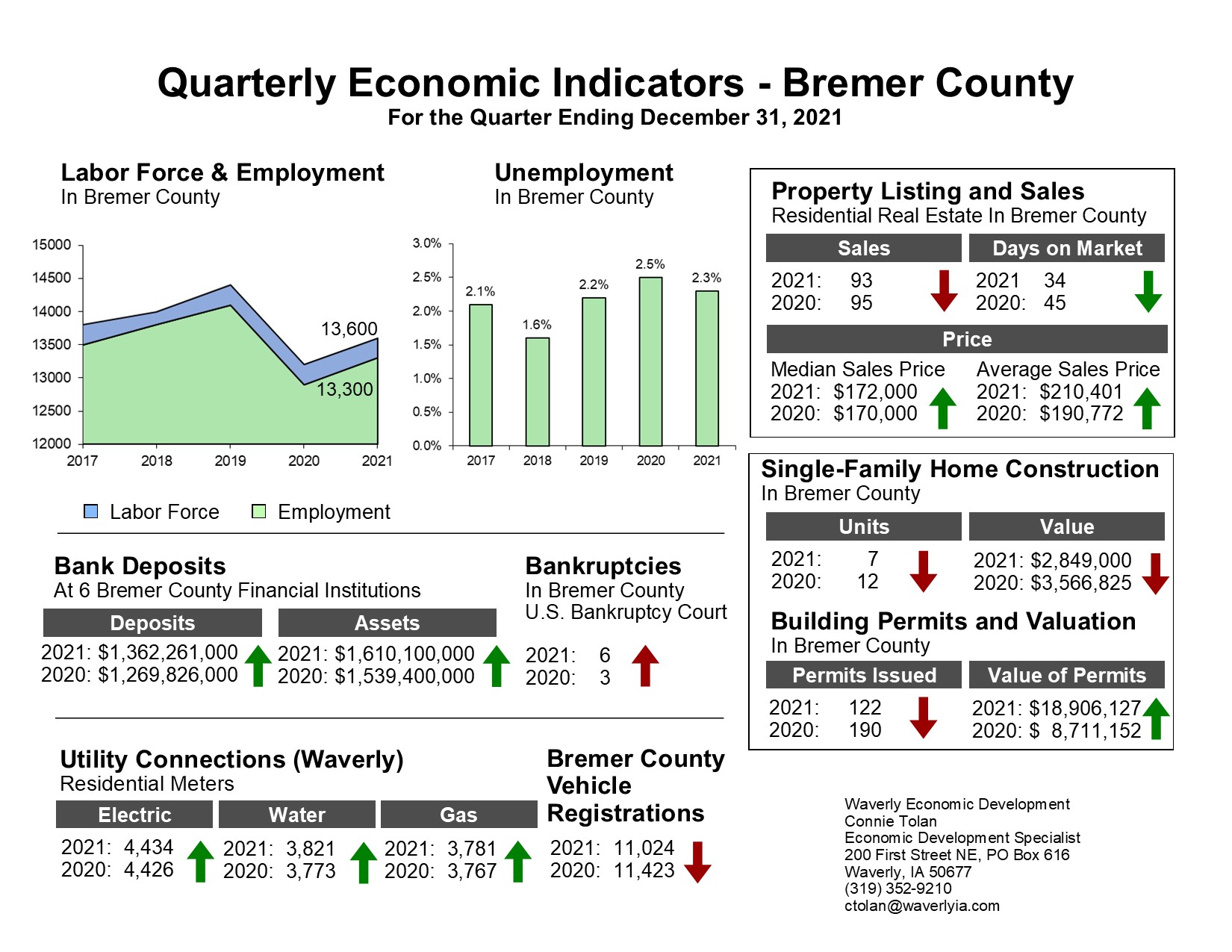

4th Quarter

Fourth quarter economic indicators were mixed. Indicators were positive in the areas of employment, bank financials, and utility connections. Residential real estate sales indicators were mostly positive as well.

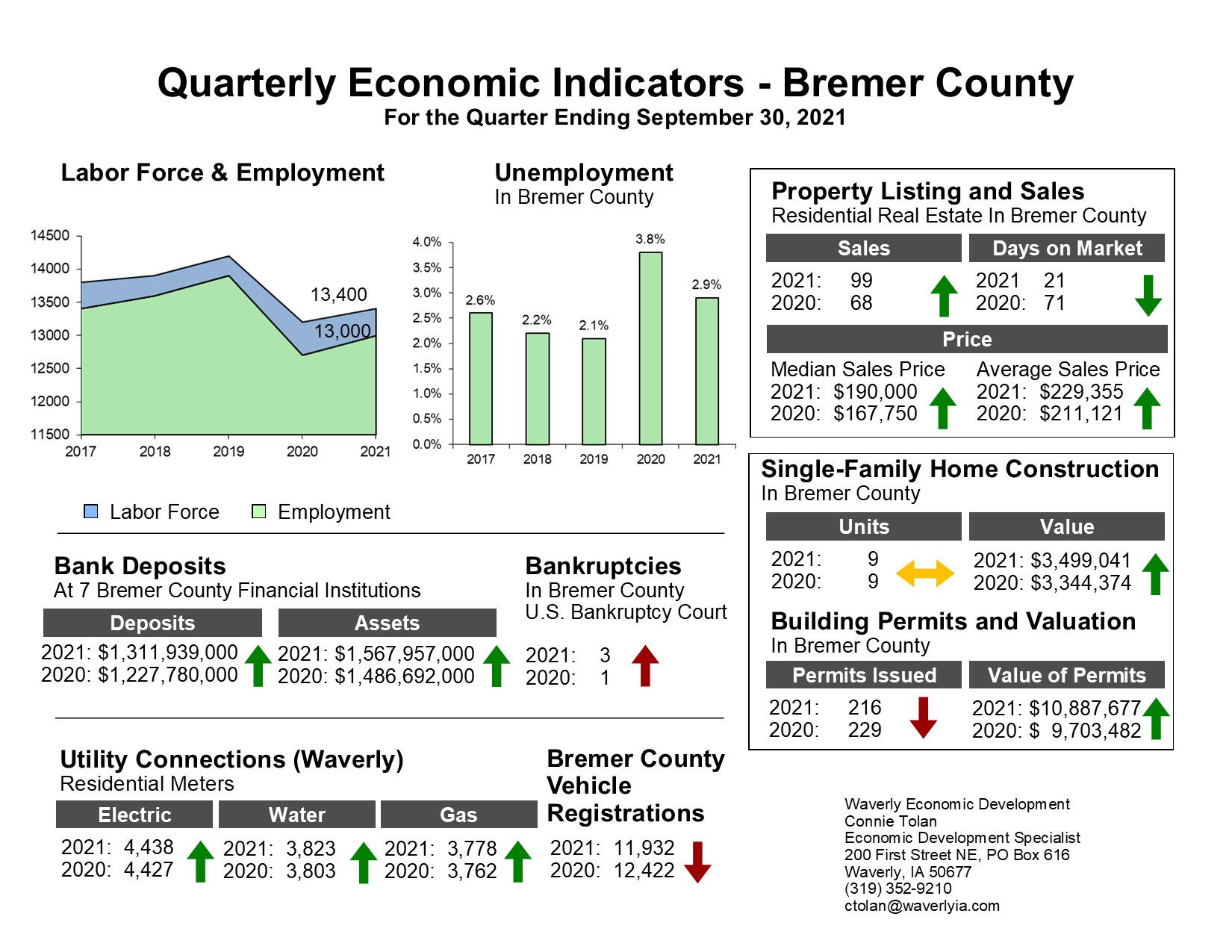

3rd Quarter

Third quarter economic indicators were mixed with real estate, bank deposits, utility connections and employment numbers trending positive. Bankruptcies and vehicle registrations trended negative with building permit activity showing mixed results.

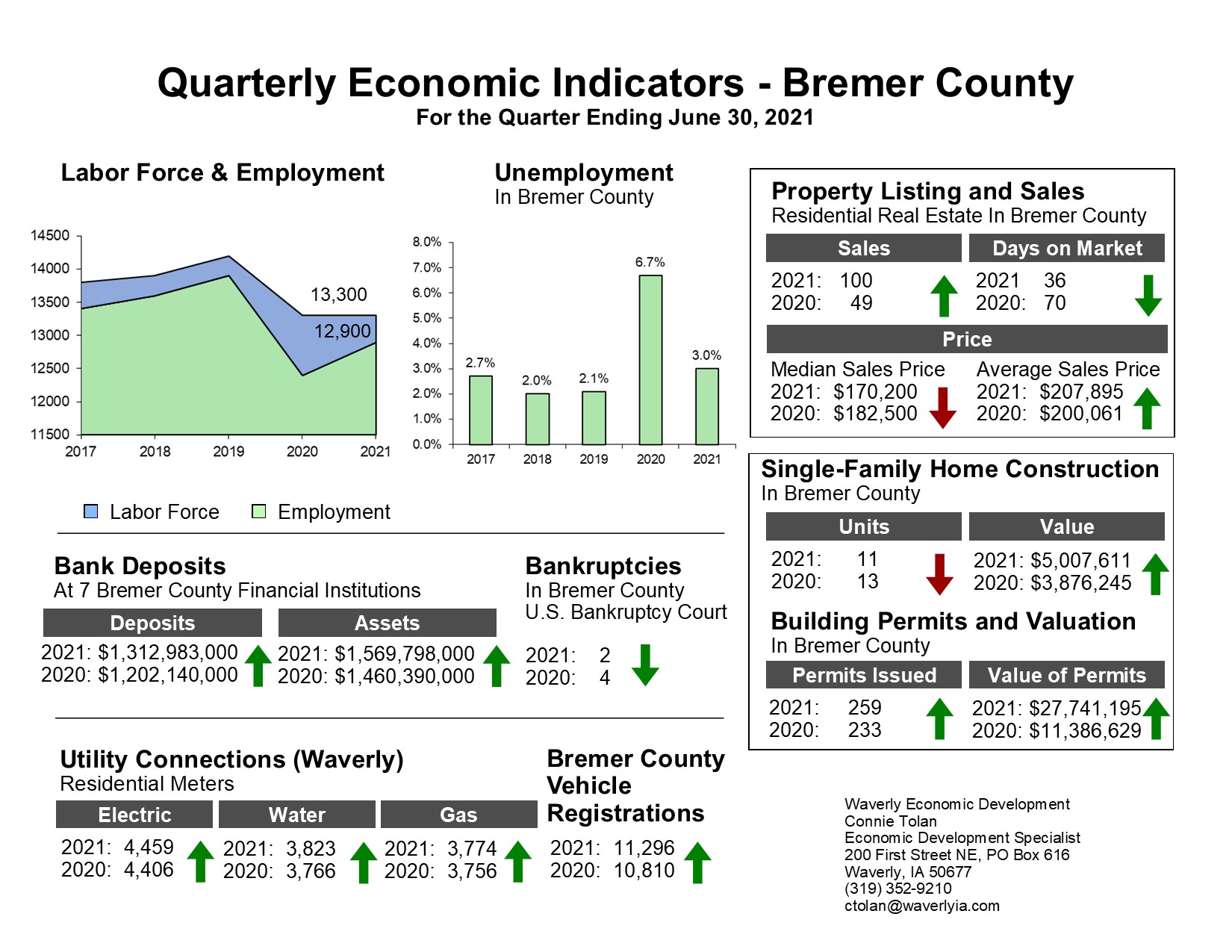

2nd Quarter

Second quarter economic indicators were positive in most categories. Residential real estate sales show a strong rebound from the pandemic effects one year ago, permits were issued for 11 new single family homes, and building permit valuation reflects a large commercial project in Denver.

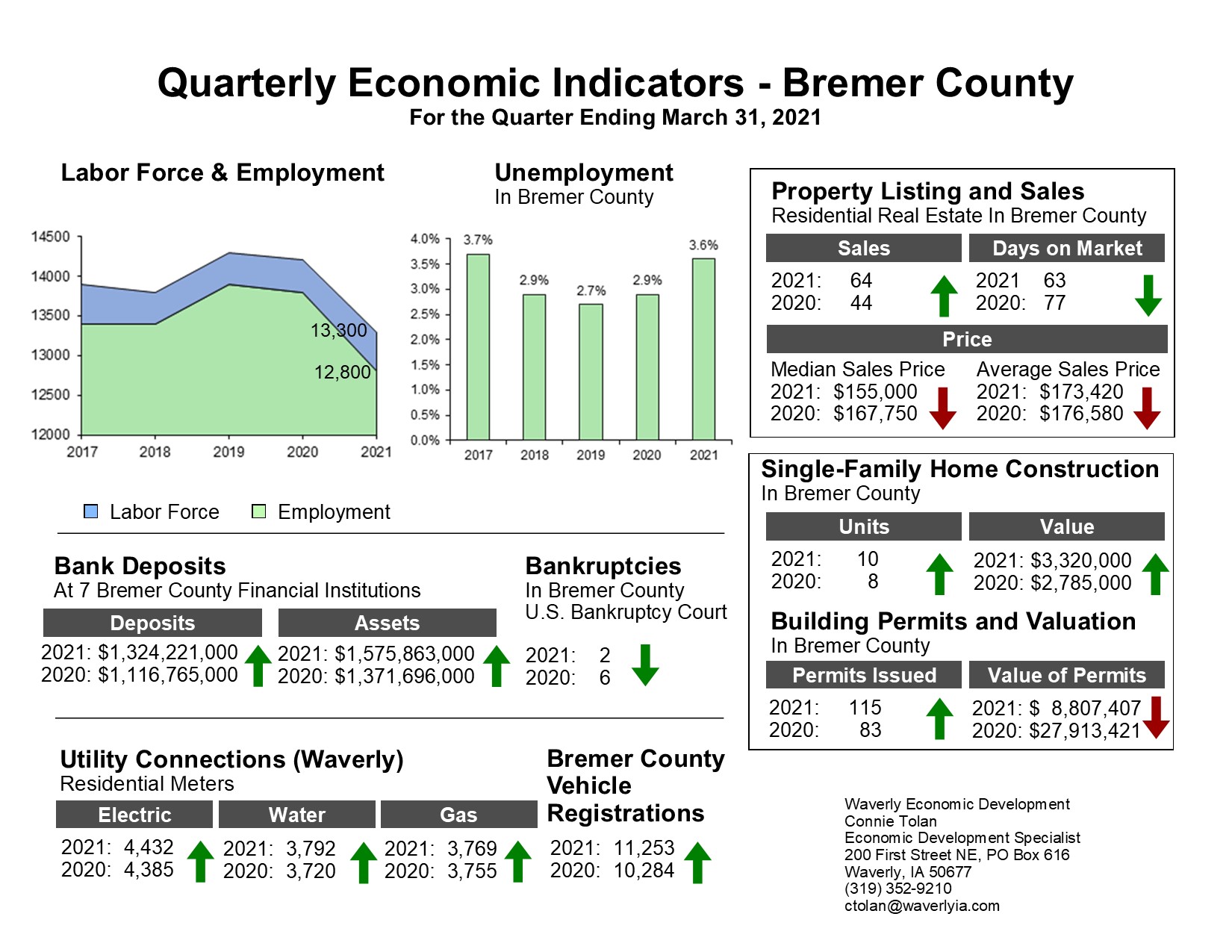

1st Quarter

First quarter economic indicators were positive in most categories. Real estate sales and new home construction numbers were up, while median and average sale prices were down. Most other indicators reflect favorable trends.First quarter economic indicators were positive in most categories. Real estate sales and new home construction numbers were up, while median and average sale prices were down. Most other indicators reflect favorable trends.

2020

4th Quarter

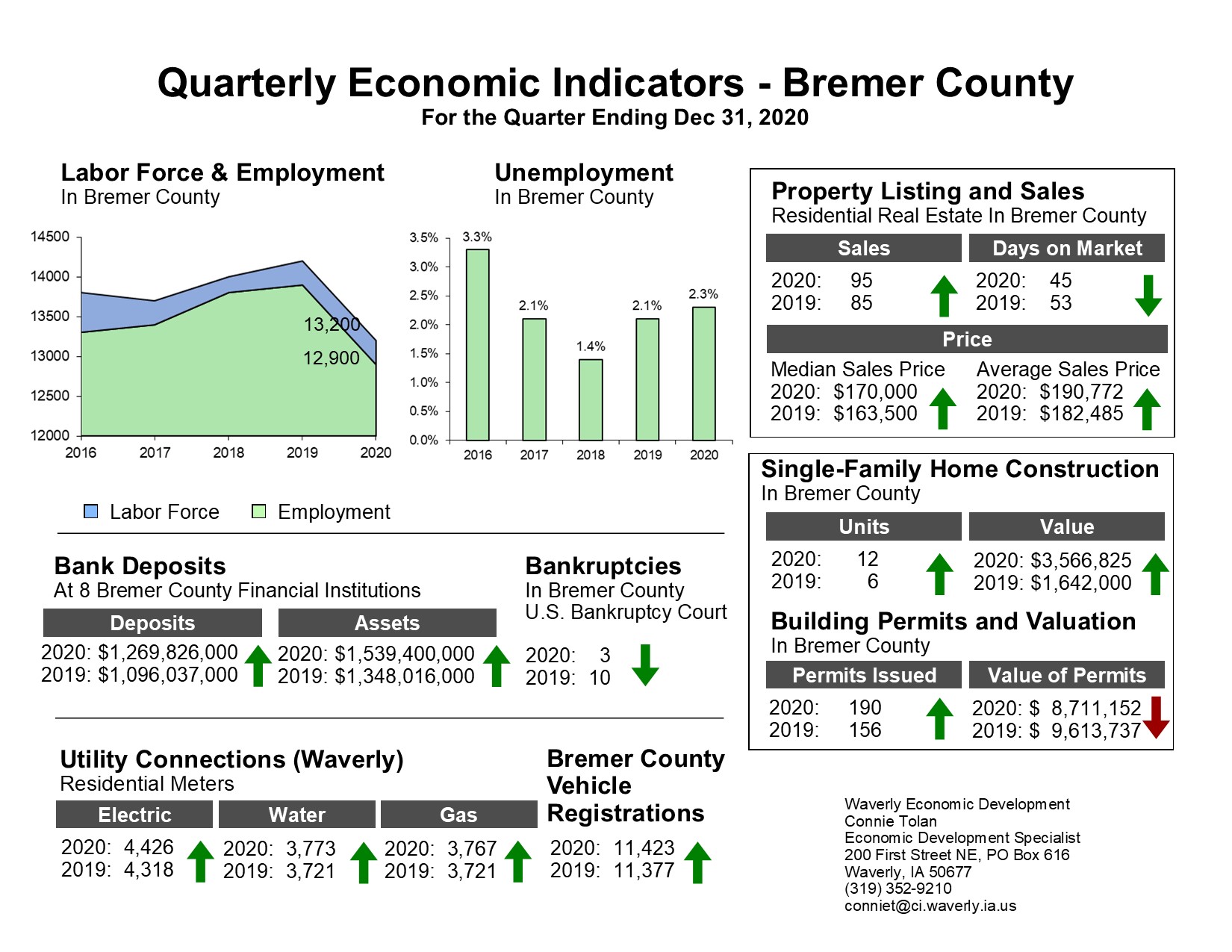

Fourth quarter economic indicators reflect progress toward recovery from the impacts of the COVID-19 pandemic, with 14 of 15 indicators showing a positive result. The unemployment rate has rebounded as well.

3rd Quarter

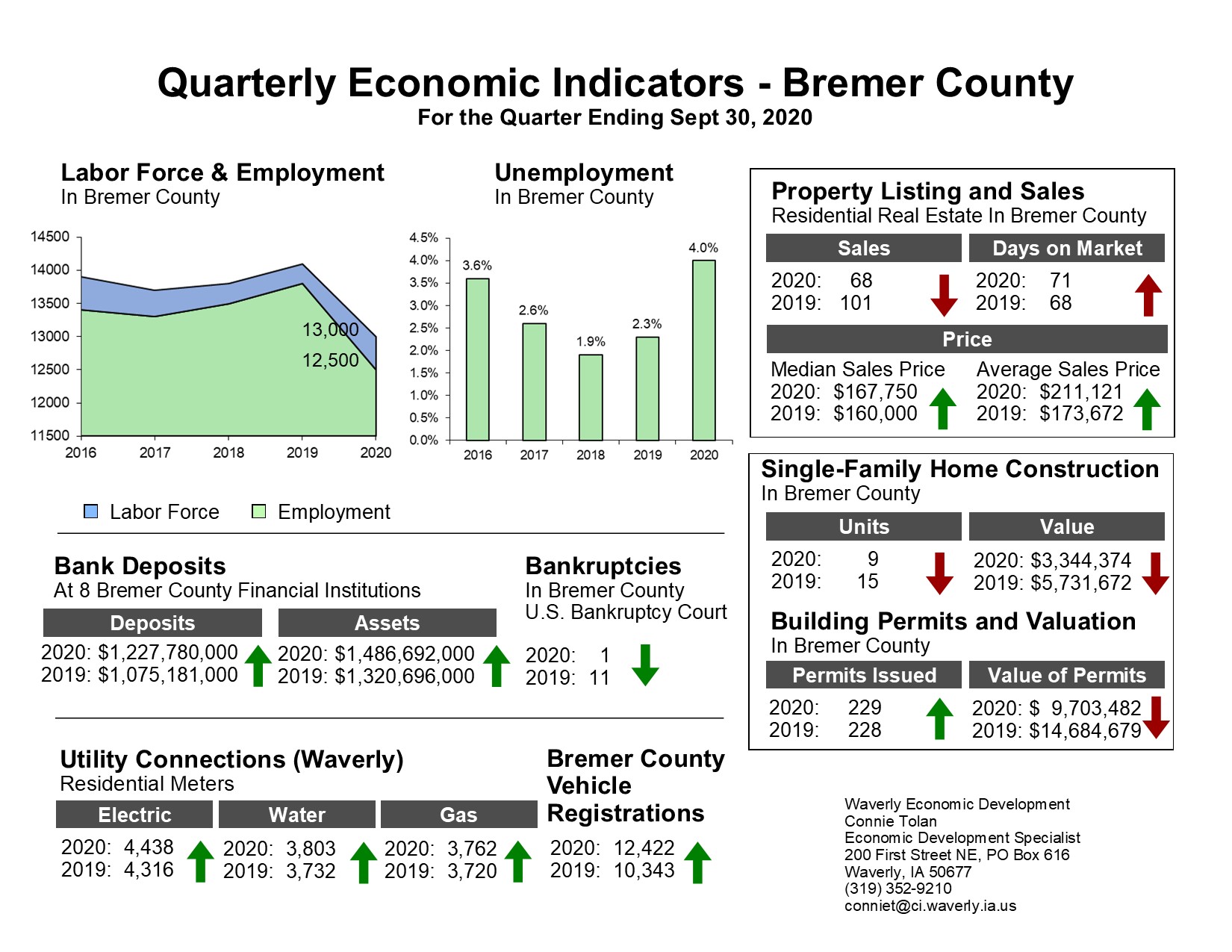

Third quarter economic indicators reflect the impact of the COVID-19 pandemic. Unemployment numbers have improved from 2nd quarter which posted a 7.6% unemployment rate. Residential real estate sales and single-family home construction are both down significantly from one year ago, while many of the remaining indicators show positive trends.

2nd Quarter

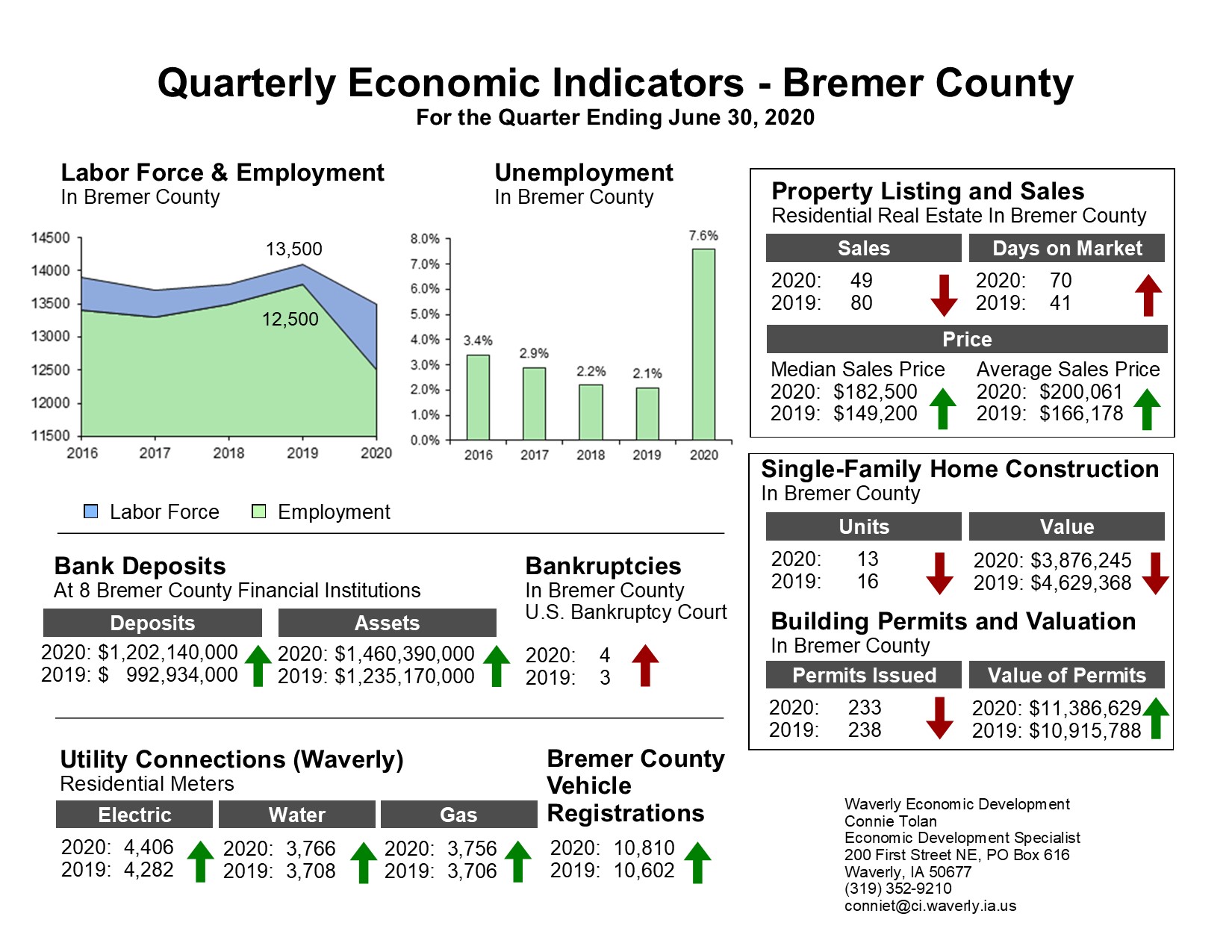

Second quarter economic indicators reflect the impact of the COVID-19 pandemic on employment numbers and real estate sales. Bank deposits, utility connections and vehicle registrations showed positive trends while construction activity showed mixed results.

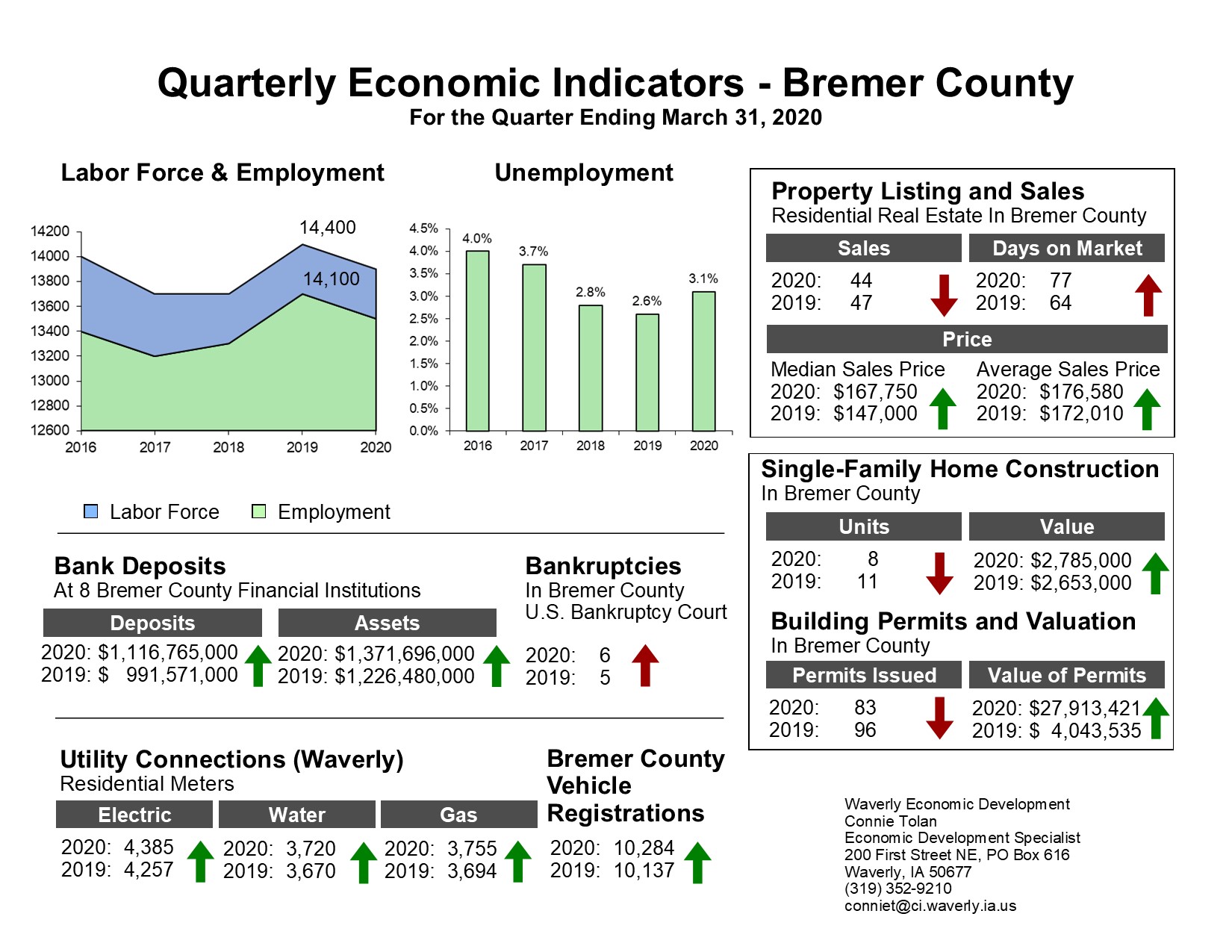

1st Quarter

First quarter economic indicators were mixed, with positive trends in bank deposits and assets, utility connections and vehicle registrations. Building permit valuations trended upward while fewer permits were issued. Real estate sales showed mixed results while bankruptcies were up slightly.

2019

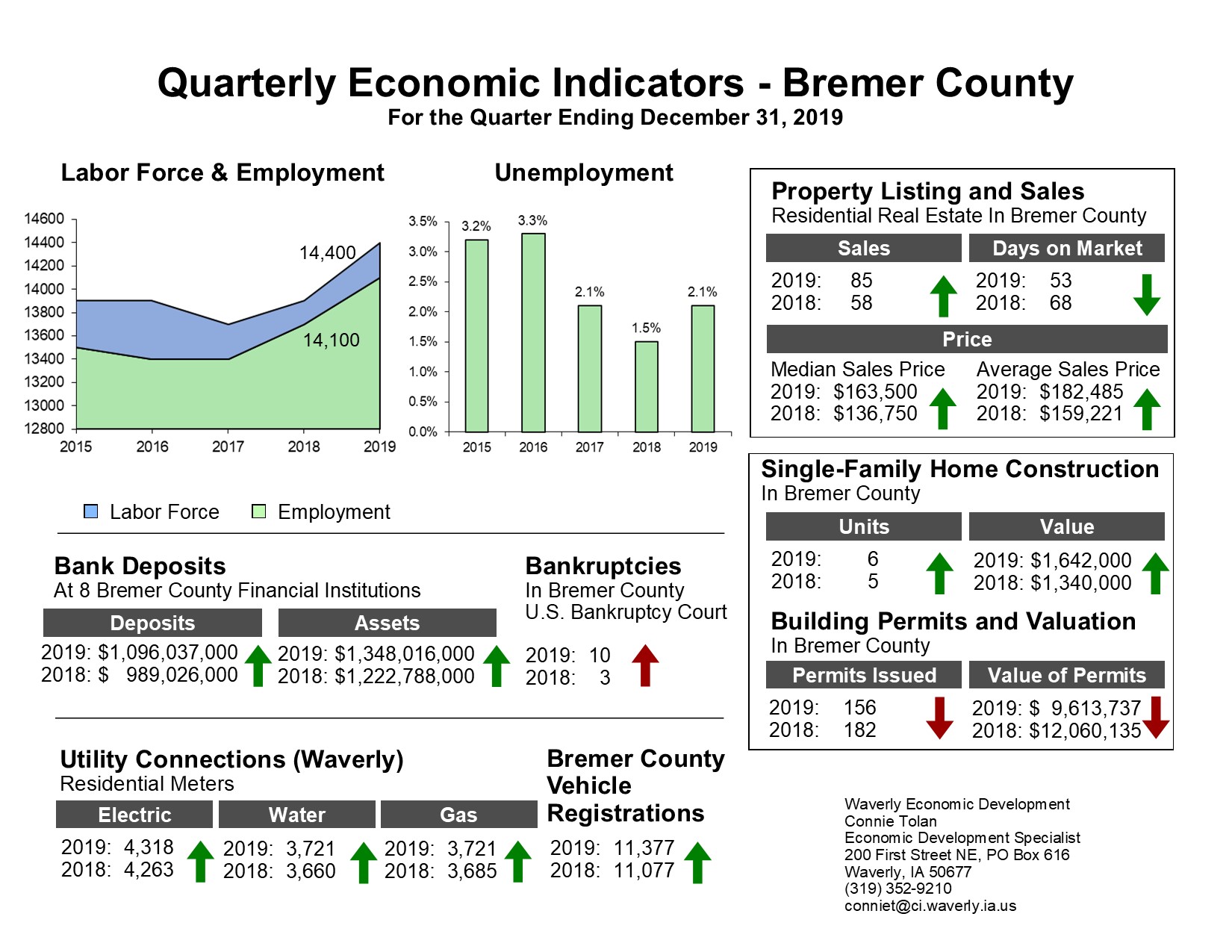

4th Quarter

Bremer County finished the year with positive indicators in most categories. Residential real estate sales were strong, as was new home construction, and bank deposits and assets showed good growth. Bankruptcies and building permits were the only indicators that did not trend in a positive direction.

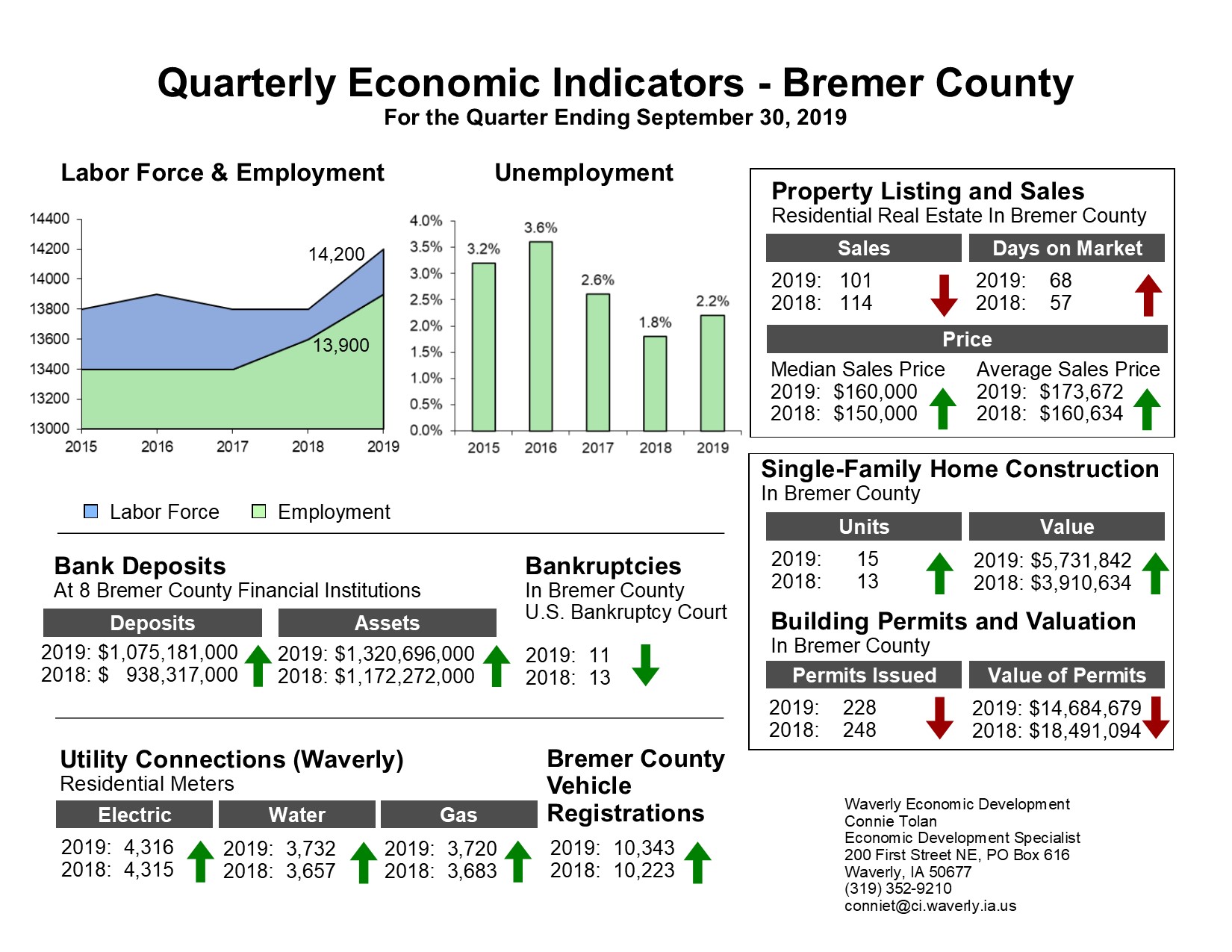

3rd Quarter

Third quarter economic indicators were positive in most categories. Bremer County financial institutions reached a significant milestone by surpassing $1 billion in deposits.

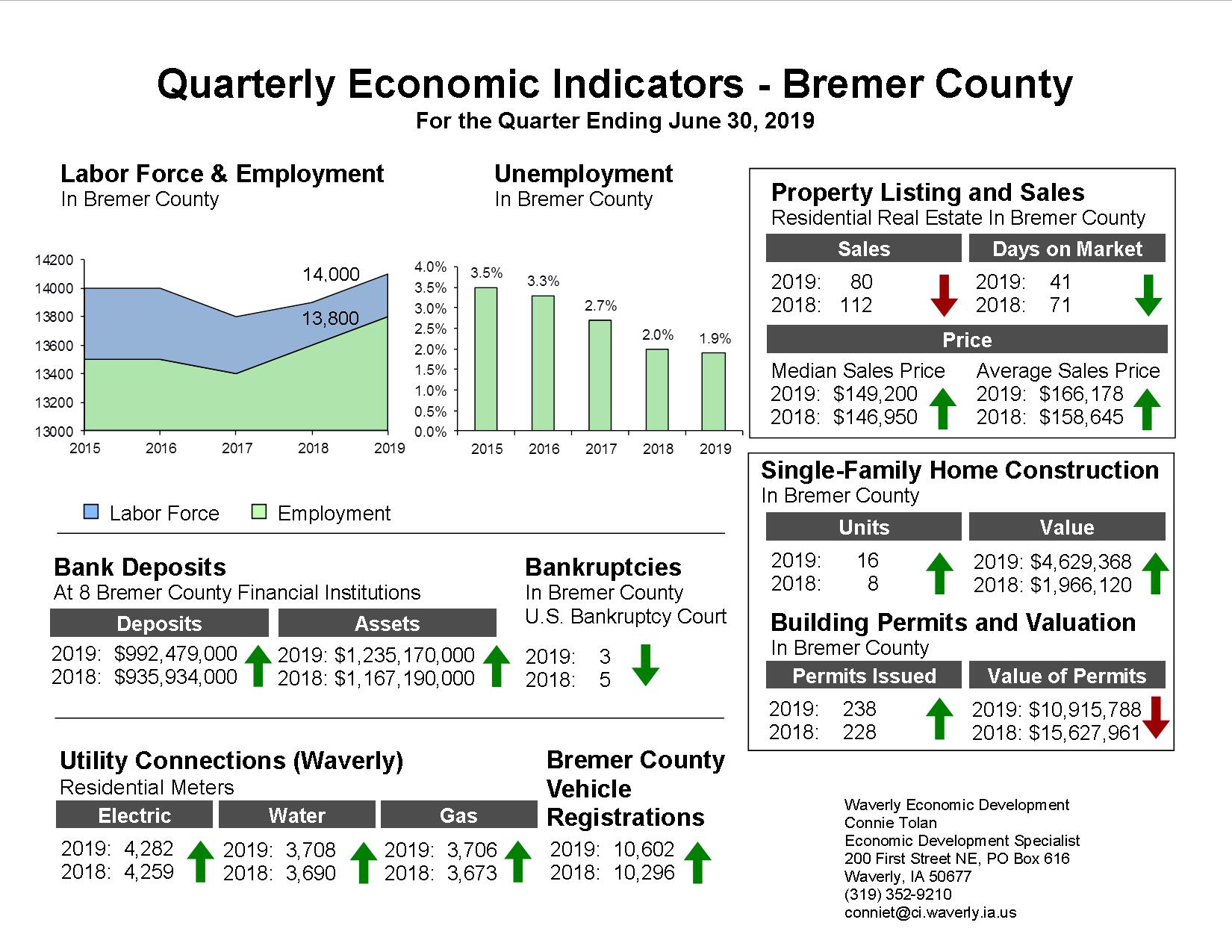

2nd Quarter

Bremer County posted solid economic numbers for the second quarter of 2019 with positive indicators in 13 of 15 categories. Bank deposits grew by $56.5 million while assets increased $67.9 million. Single family home construction outpaced last year while employment numbers remain strong.

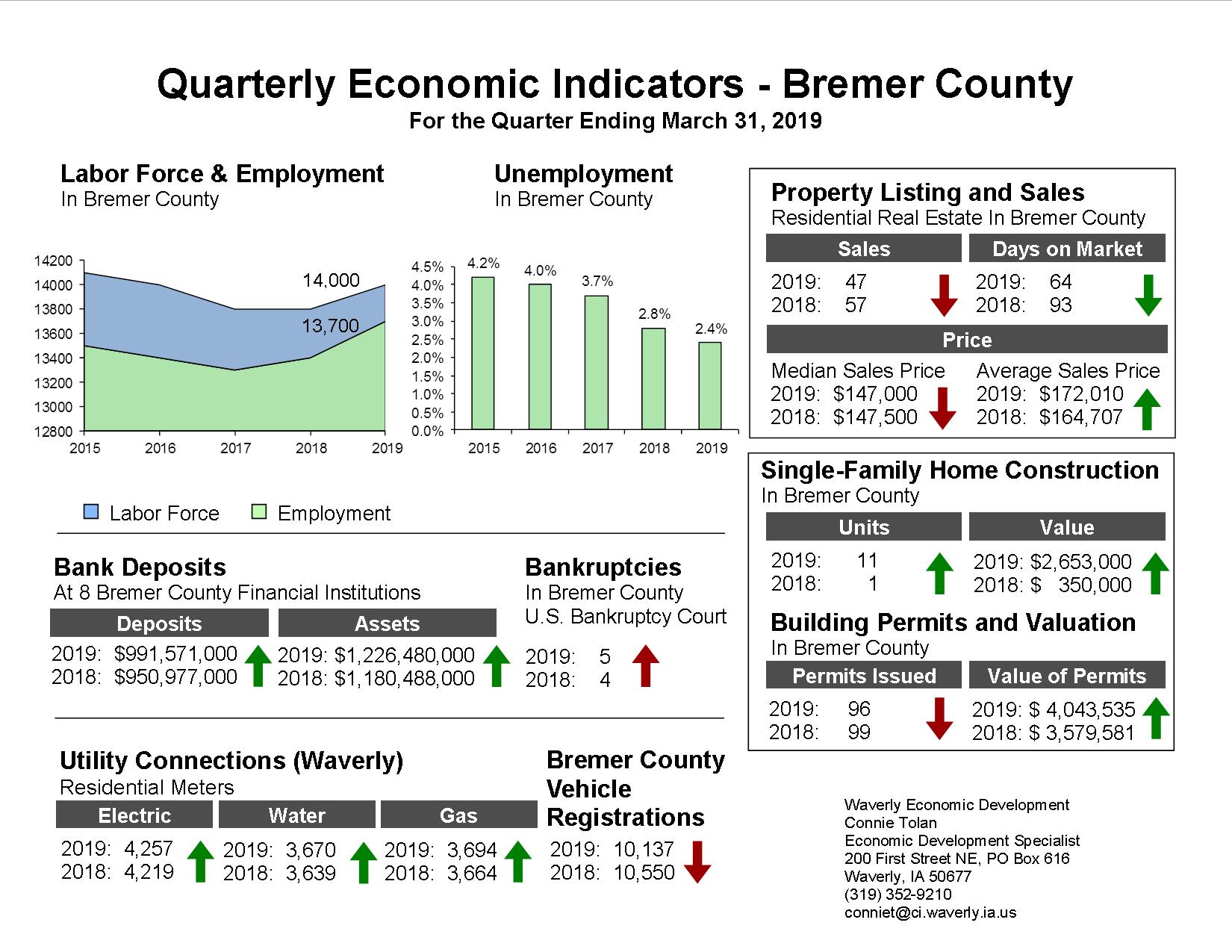

1st Quarter

First quarter economic indicators are positive in the areas of employment, bank assets/deposits, utility connections and new home construction. There were more bankruptcies and fewer vehicle registrations, while residential real estate sales showed mixed results.

2018

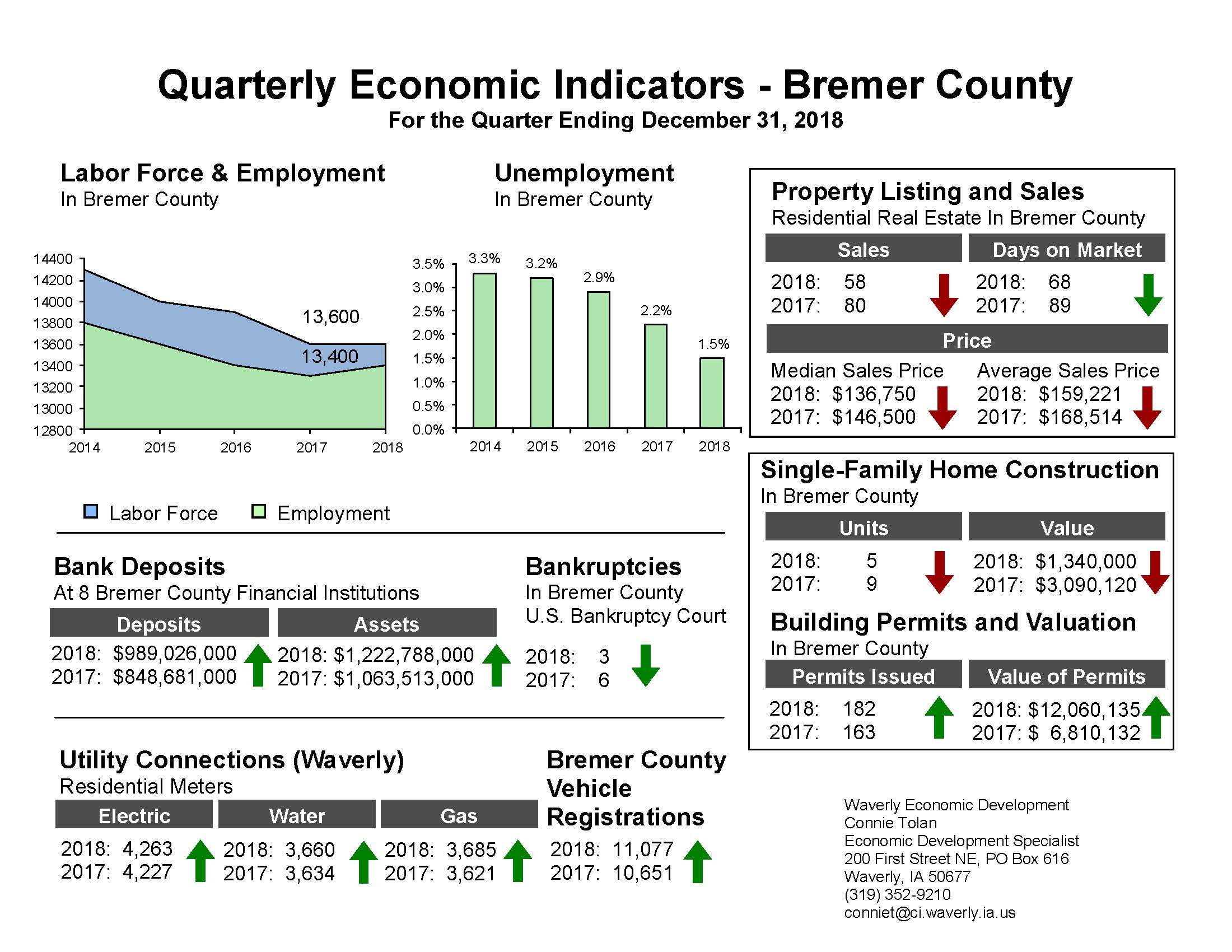

4th Quarter

Fourth quarter economic indicators are positive in the areas of building permits, bank assets and deposits, utility connections, bankruptcies, vehicle registrations and employment while real estate sales and single family home construction numbers are down.

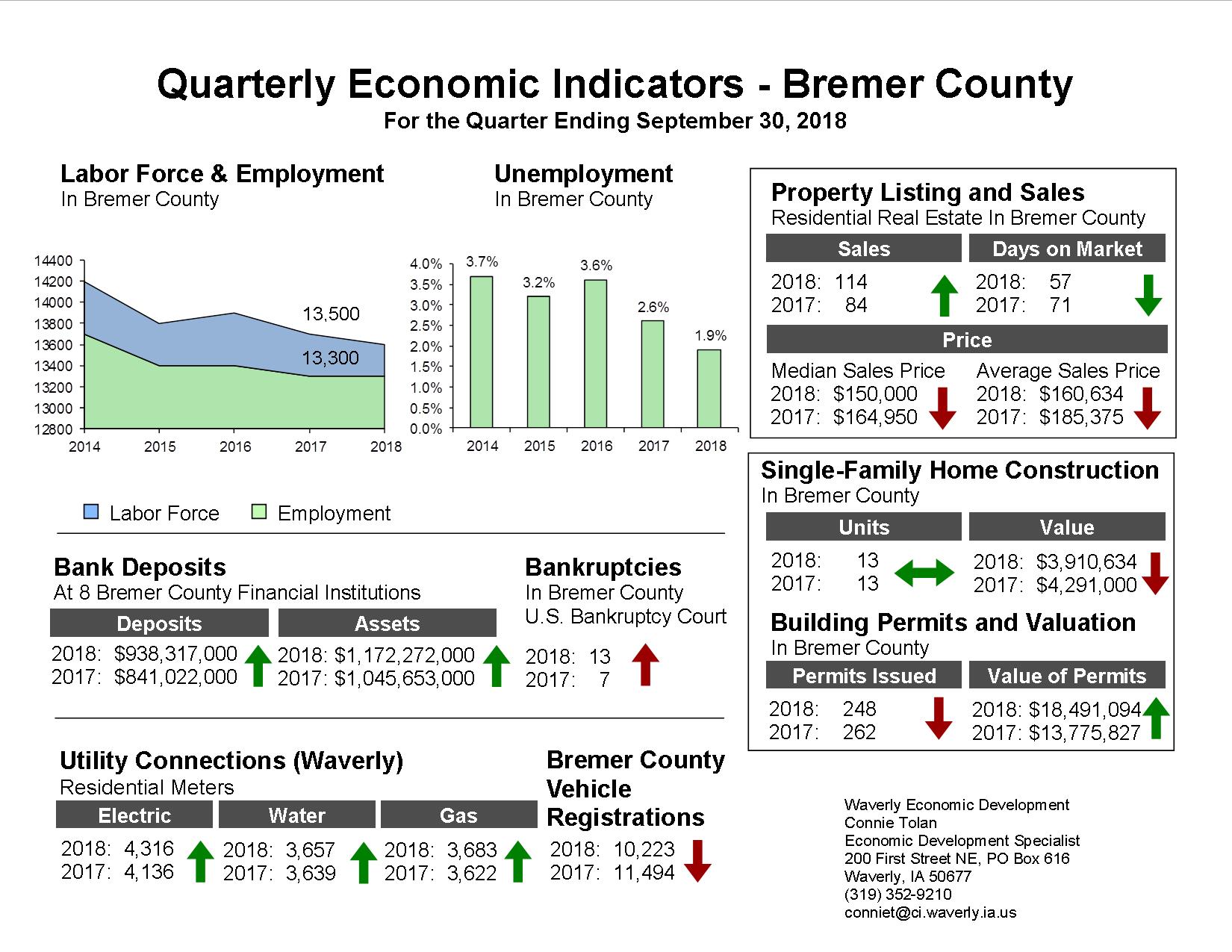

3rd Quarter

Third quarter economic indicators show positive trends in residential real estate sales, utility connections and bank deposits and assets. Vehicle registrations are down, bankruptcies are up and building permit activity shows mixed results. Employment numbers continue to reflect strong participation rates.

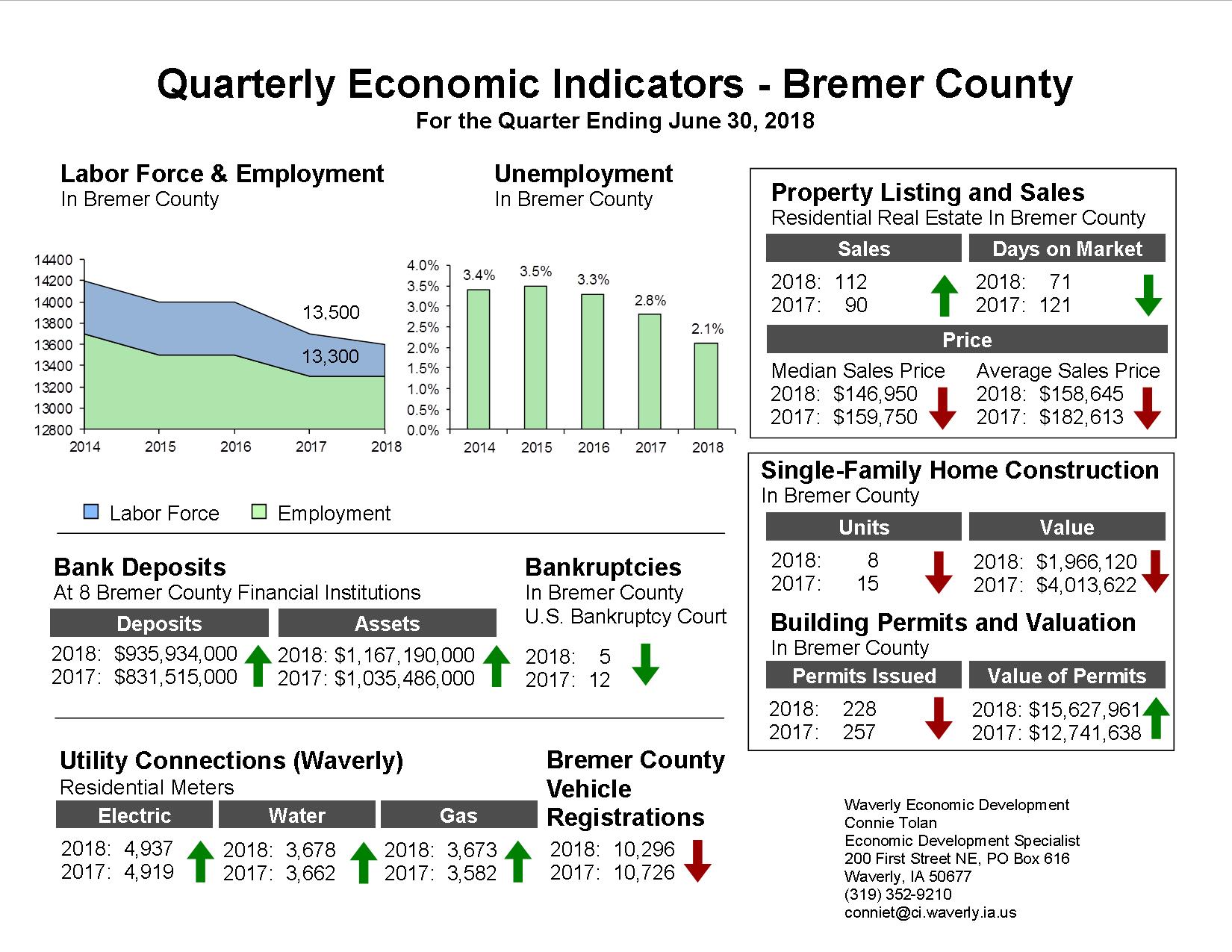

2nd Quarter

Second quarter economic indicators show strong employment levels, fewer bankruptcies, and growing bank deposits and assets. Residential property sales are up 24% with fewer days on market, while building permit numbers are down compared to a year ago.

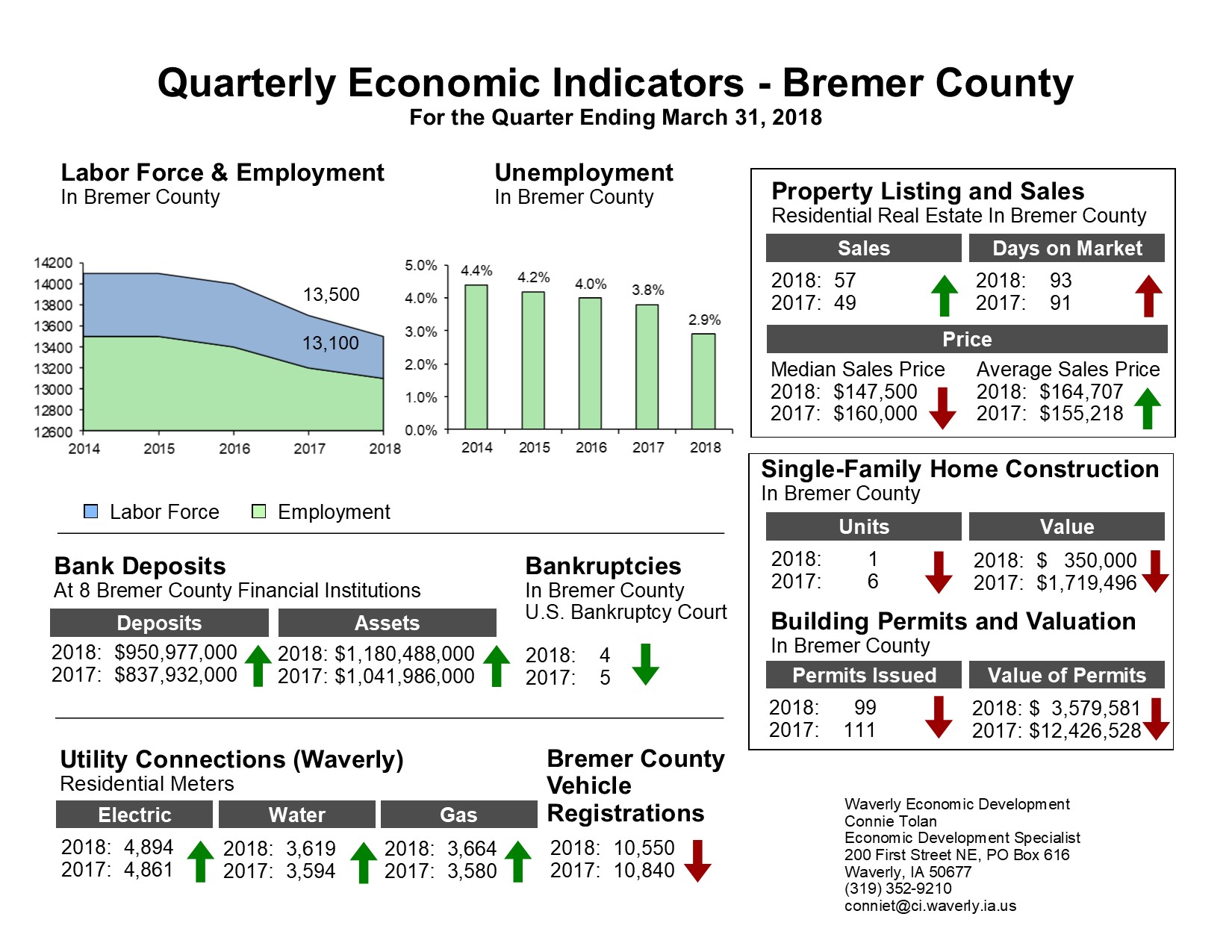

1st Quarter

First quarter economic indicators show positive trends in many categories including bank deposits and assets, utility connections and real estate sales. Employment remains strong while construction permits are down from a year ago.

2017

4th Quarter

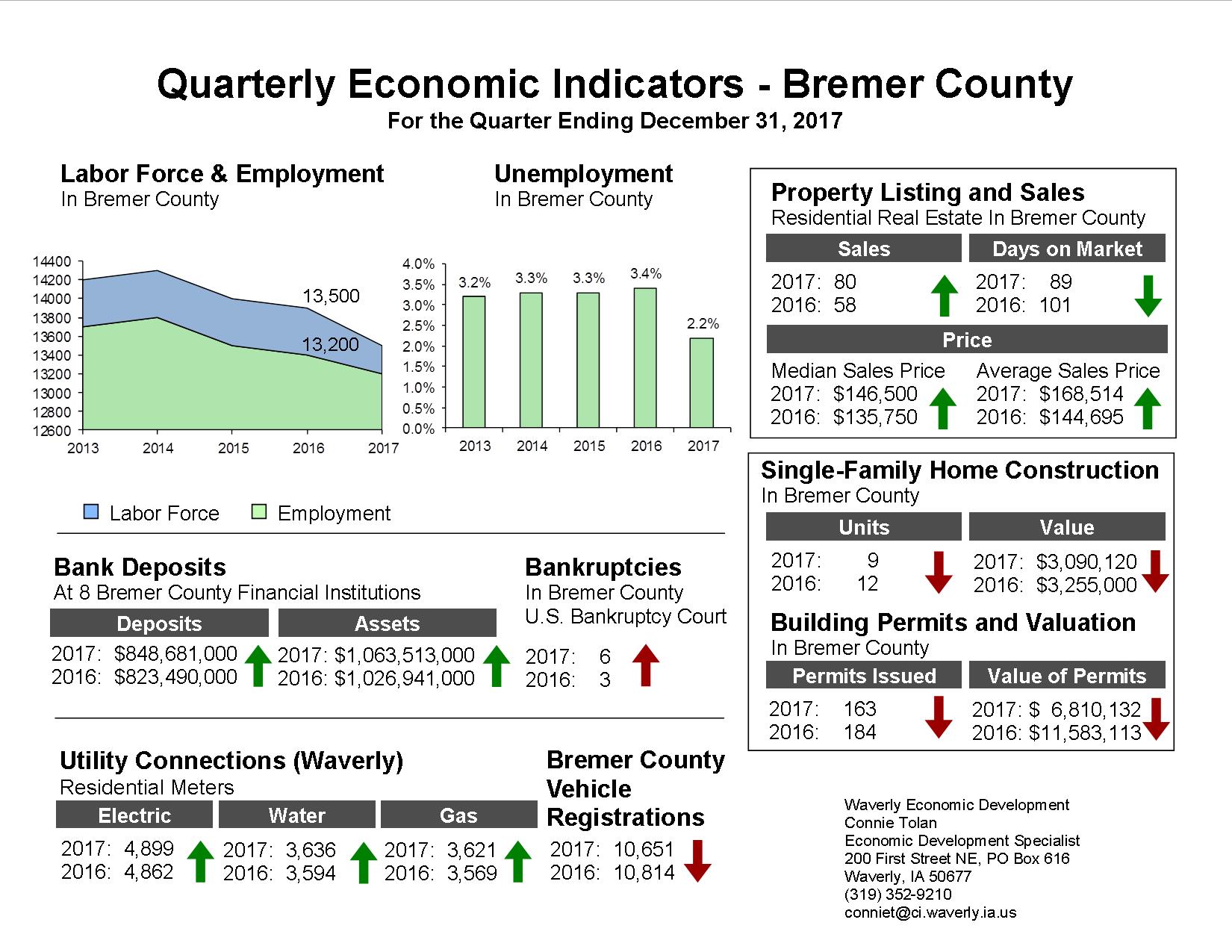

Fourth quarter economic indicators show Bremer County ended 2017 with growing bank deposits and assets, strong residential real estate sales, low unemployment, and utility connection increases reflective of residential construction growth, despite fewer permits issued compared to 4th quarter 2016.

3rd Quarter

Third quarter economic indicators show strong employment levels, growing bank deposits and assets, and an increase in vehicle registrations. Residential real estate sales show mixed results and bankruptcy numbers are up. Construction permits for this quarter are down from a year ago while increased utility connections are reflective of continued residential construction growth in the county.

.jpg)

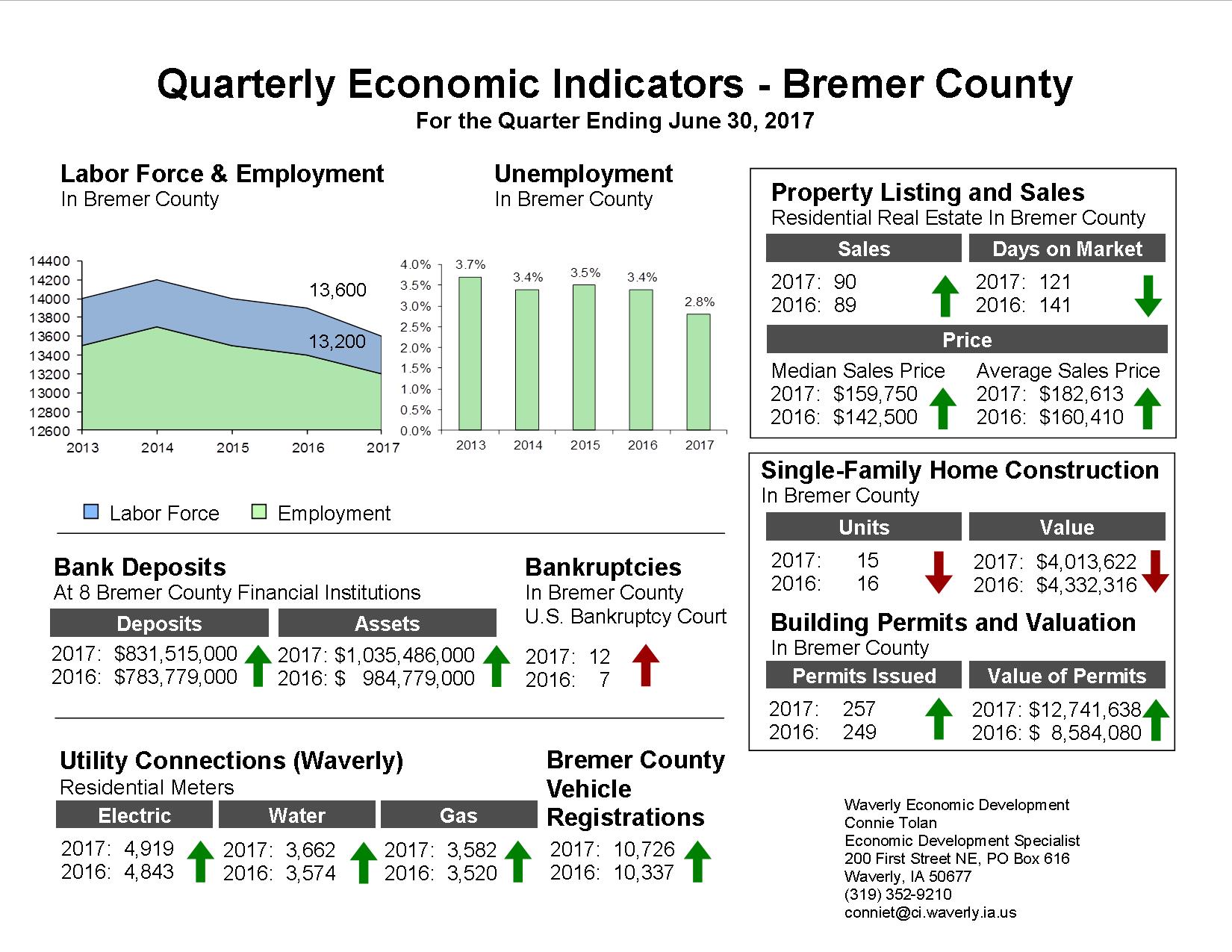

2nd Quarter

Second quarter economic indicators show positive results in nearly every category. Bank deposits and assets continue to grow, residential real estate trends are positive, building permit activity remains strong with only a slight decrease in new home construction permits. Bankruptcies are higher than a year ago, while employment remains strong in the area.

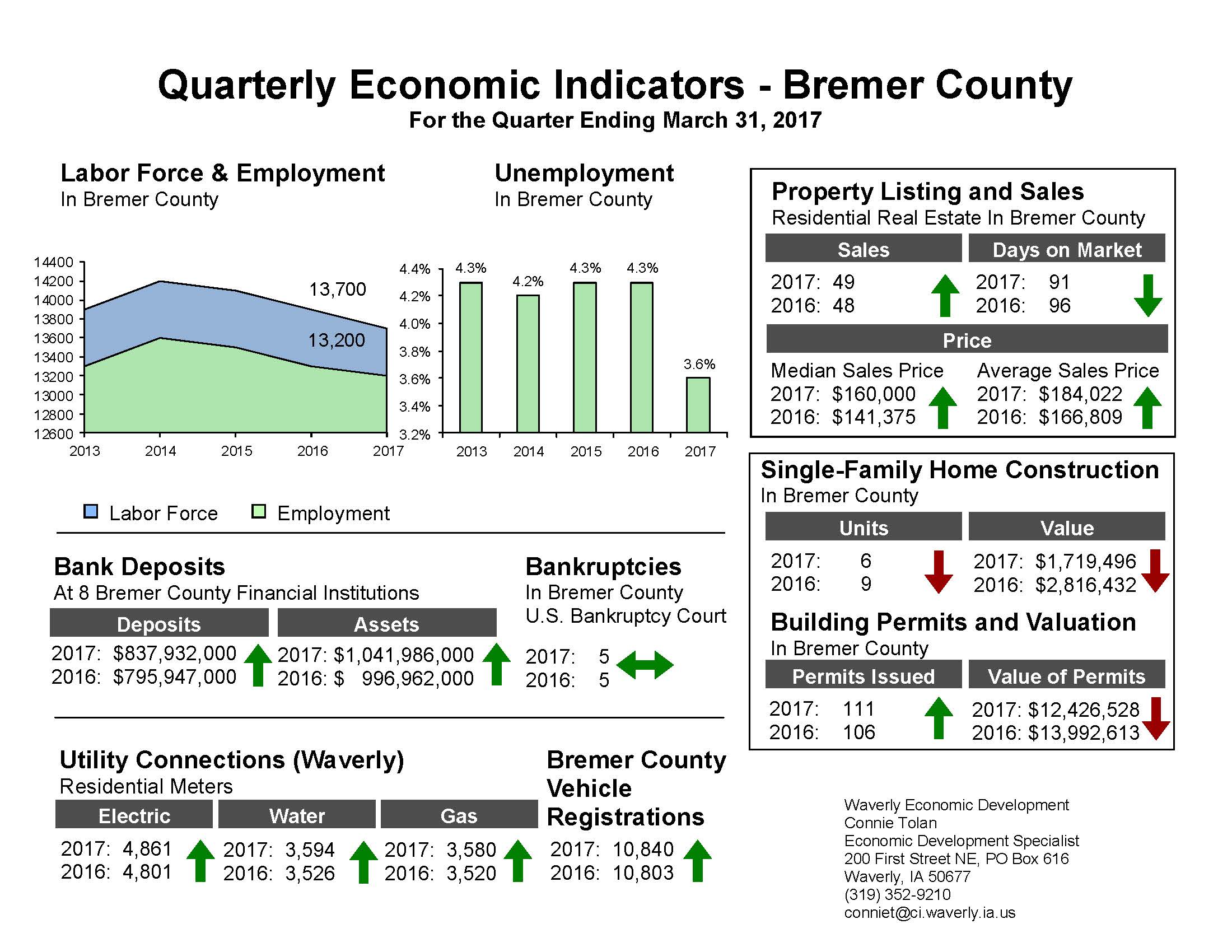

1st Quarter

Bremer County started the year off strong with a number of positive first quarter economic indicators. Positive trends were noted in real estate sales, utility connections, bank deposits and vehicle registrations.

Construction numbers were mixed while employment in the county continues to be robust.

2016

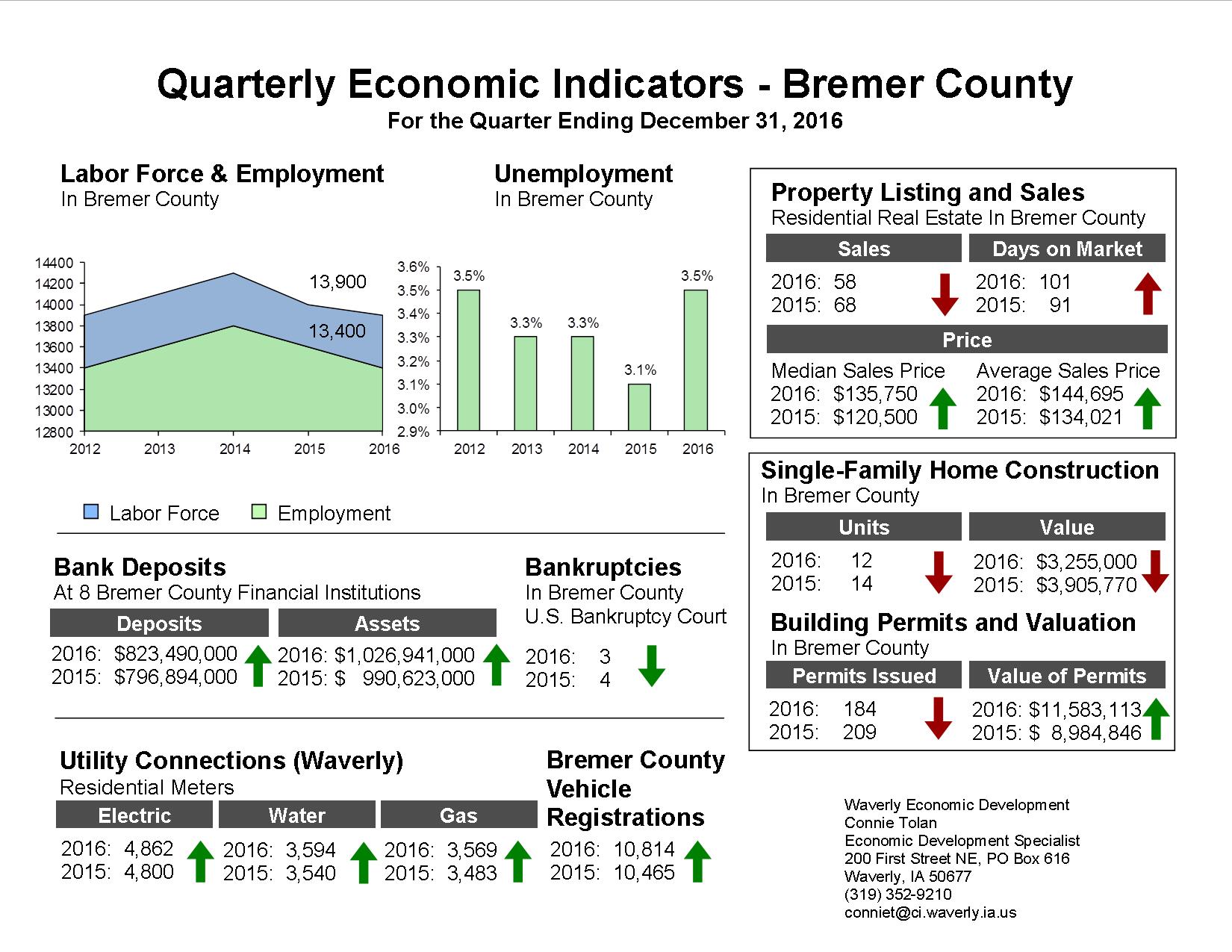

4th Quarter

Bremer County financial institutions reached a significant milestone by surpassing $1 billion in assets for year-end 2016. Construction and real estate data showed mixed results, while positive trends continued in bankruptcy numbers, utility connections and vehicle registrations. Employment numbers continue to be strong despite a small increase in unemployment for the quarter.

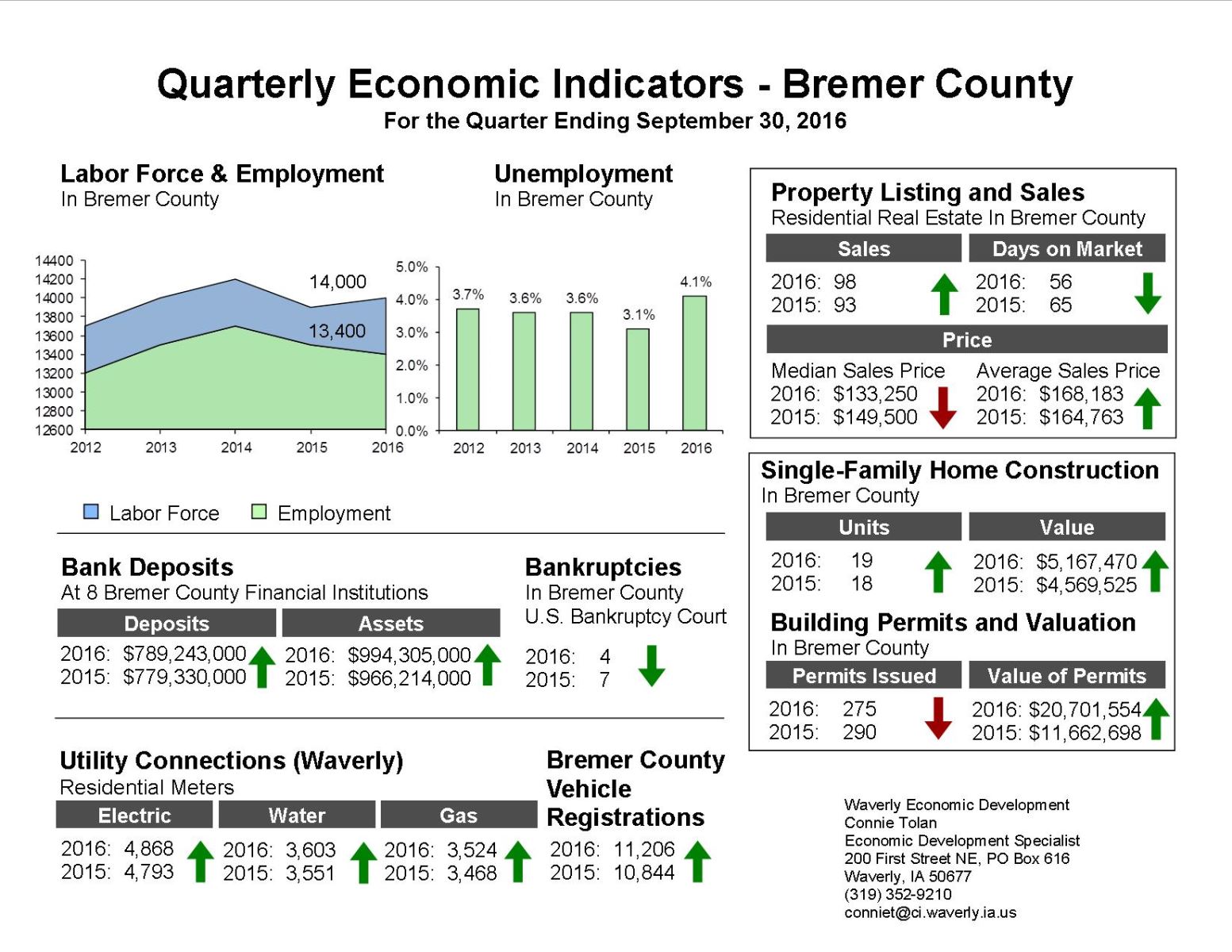

3rd Quarter

Bremer County posted solid economic numbers for the third quarter of 2016. Construction and real estate data reflect strong investment and bank deposits and assets continue to grow. Bankruptcies are down and vehicle registrations up. Employment numbers continue to be sound despite a small uptick in unemployment.

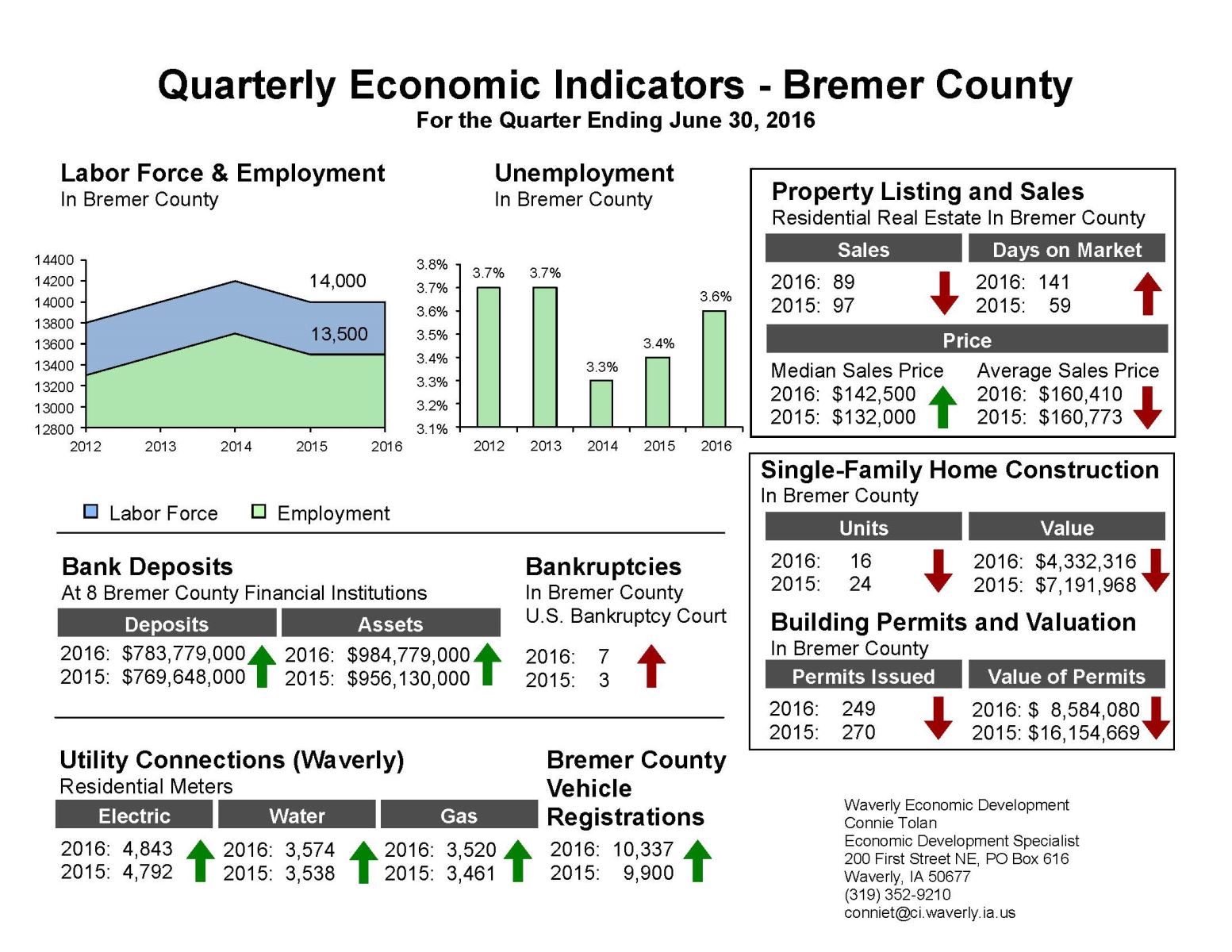

2nd Quarter

Second quarter economic indicators for Bremer County show strong employment numbers and continued growth in bank assets and deposits, while construction and real estate numbers are down from a year ago.

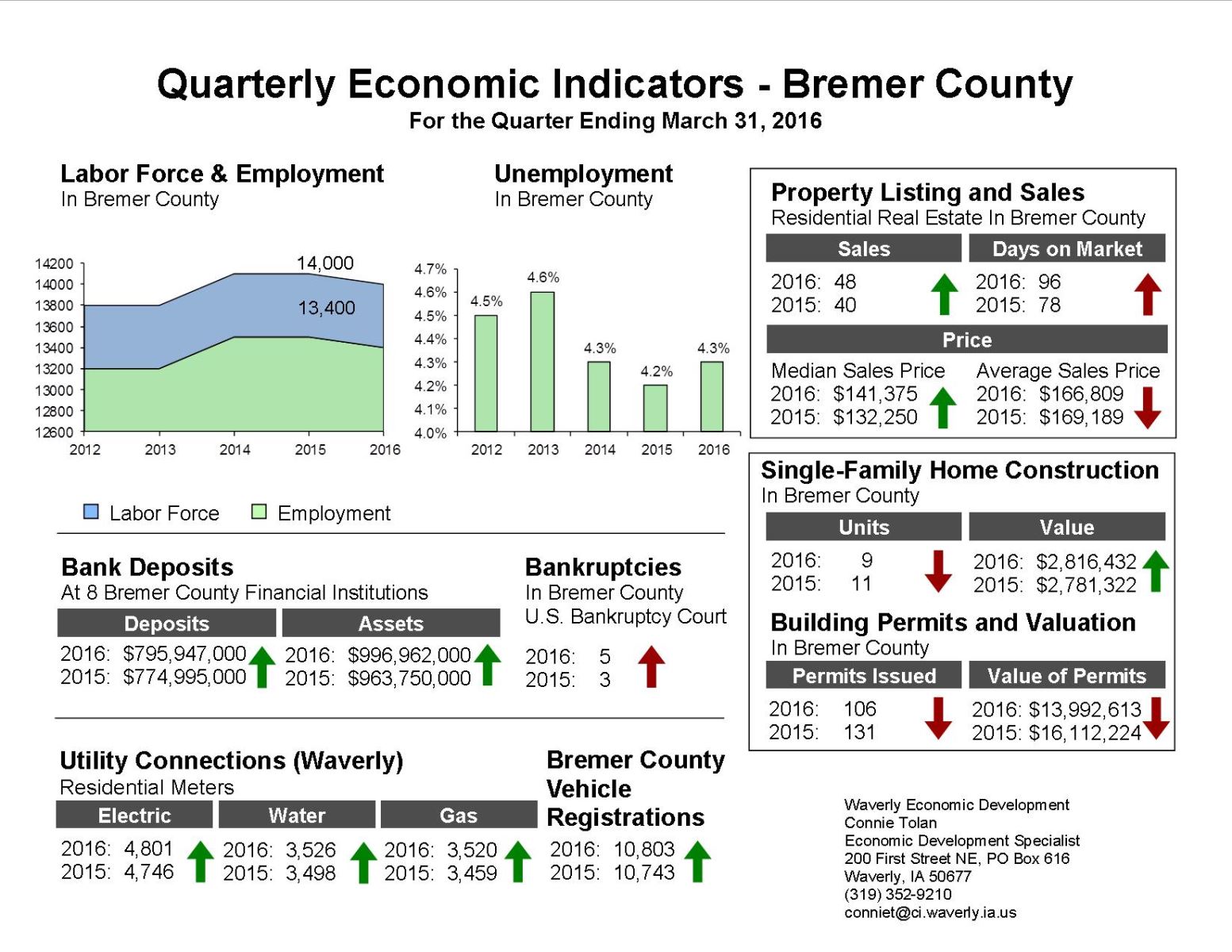

1st Quarter

First quarter economic indicators for Bremer County showed mixed results for residential real estate sales and new home construction while employment figures remained strong. Bank deposits and assets, utility connections and vehicle registrations all showed positive trends.

2015

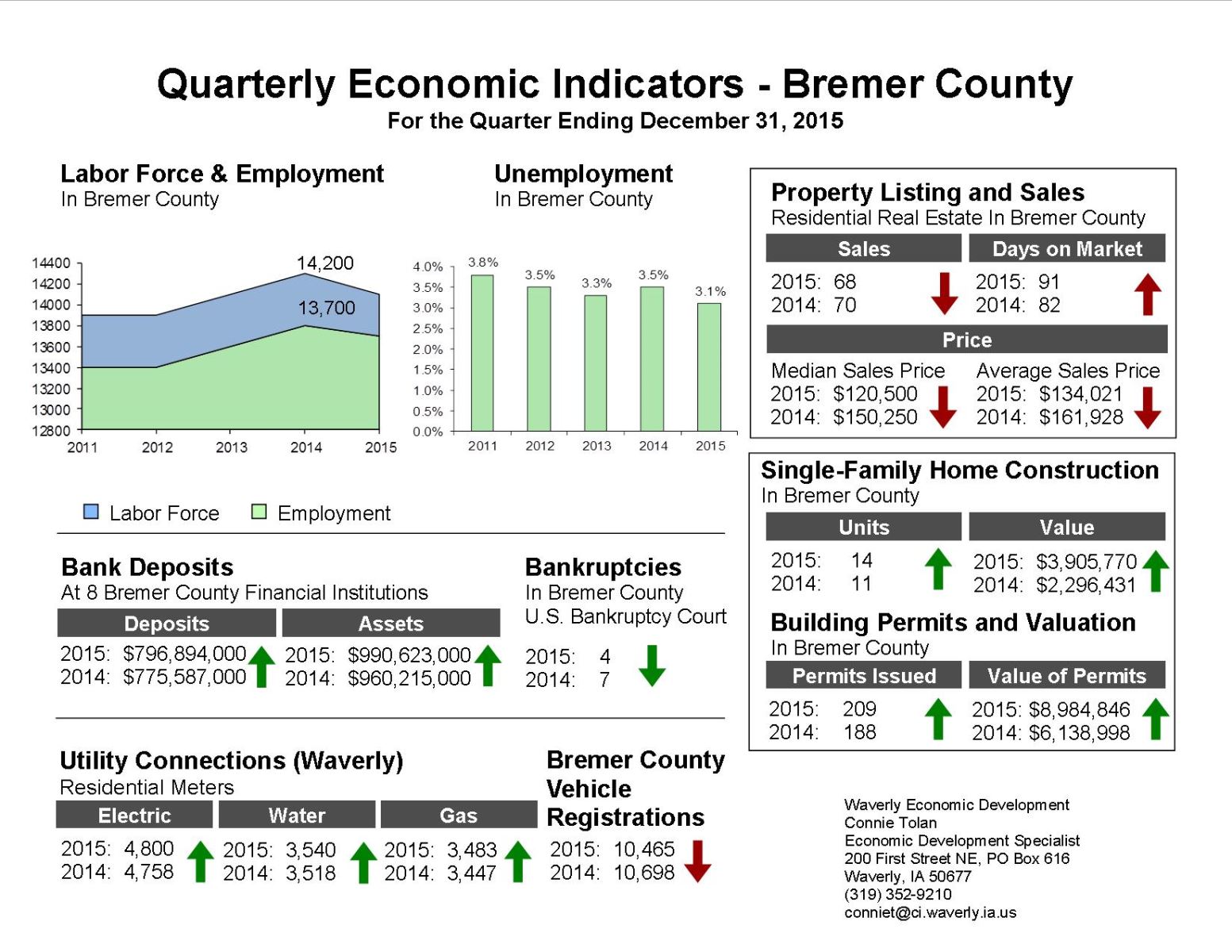

4th Quarter

Bremer County ended 2015 with strong employment figures and continued growth in bank deposits and assets. Construction figures reflect strong investment while residential real estate sales were down slightly.

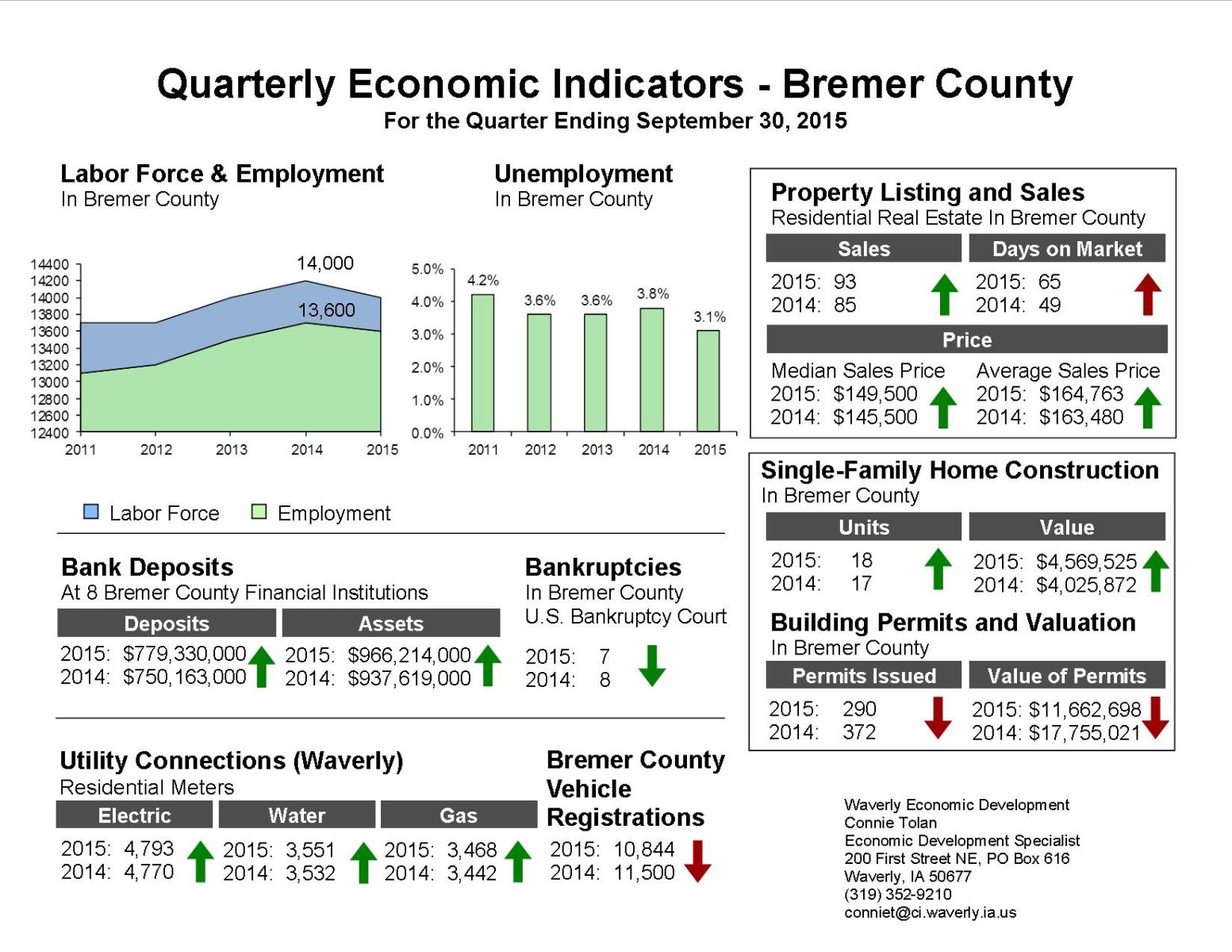

3rd Quarter

Bremer County experienced another positive quarter economically, led by a strong housing market, growing bank deposits, and continued stability in employment numbers.

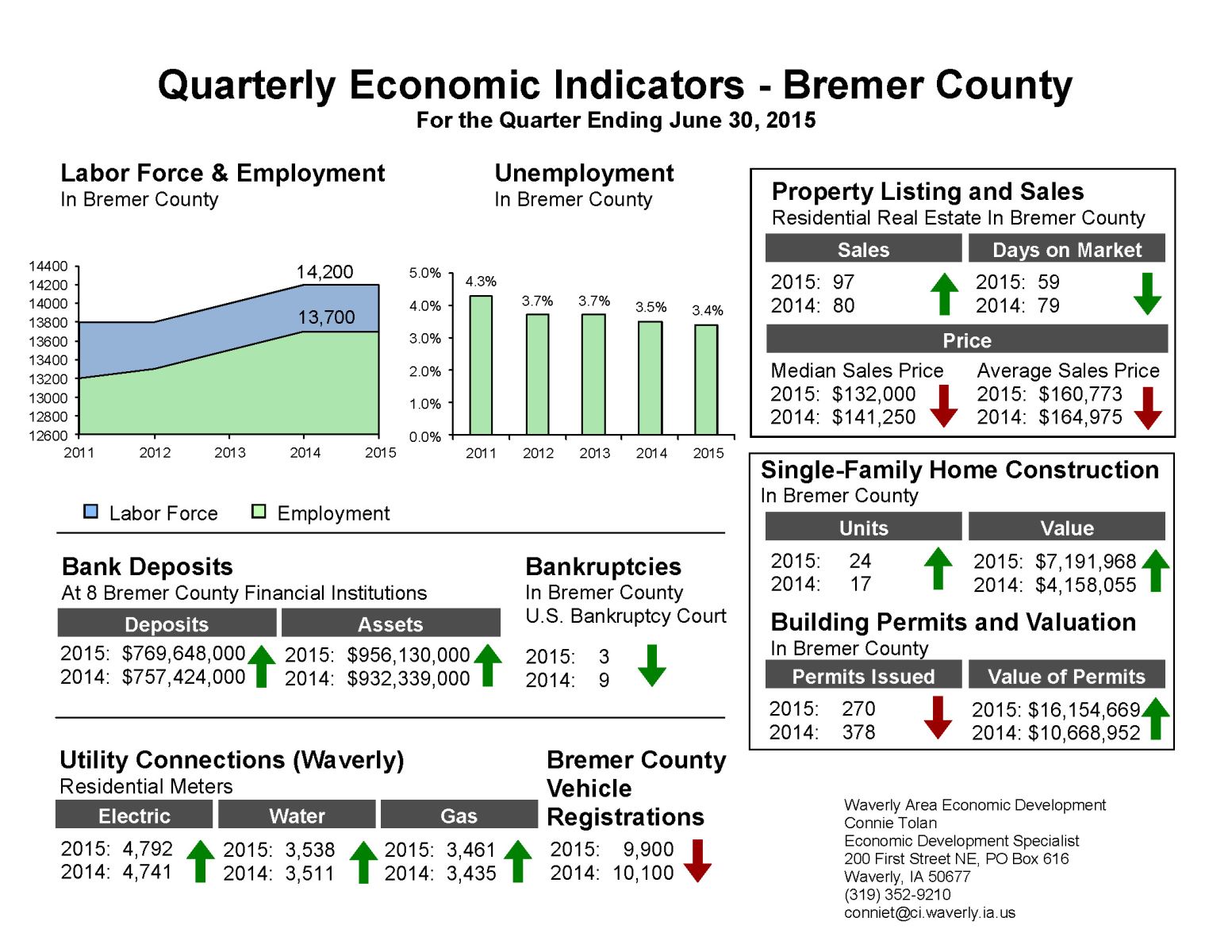

2nd Quarter

A strong housing market is reflected in the second quarter economic indicators for Bremer County. Home sales are up, days on market down, and new home construction figures outpaced the same quarter a year ago.

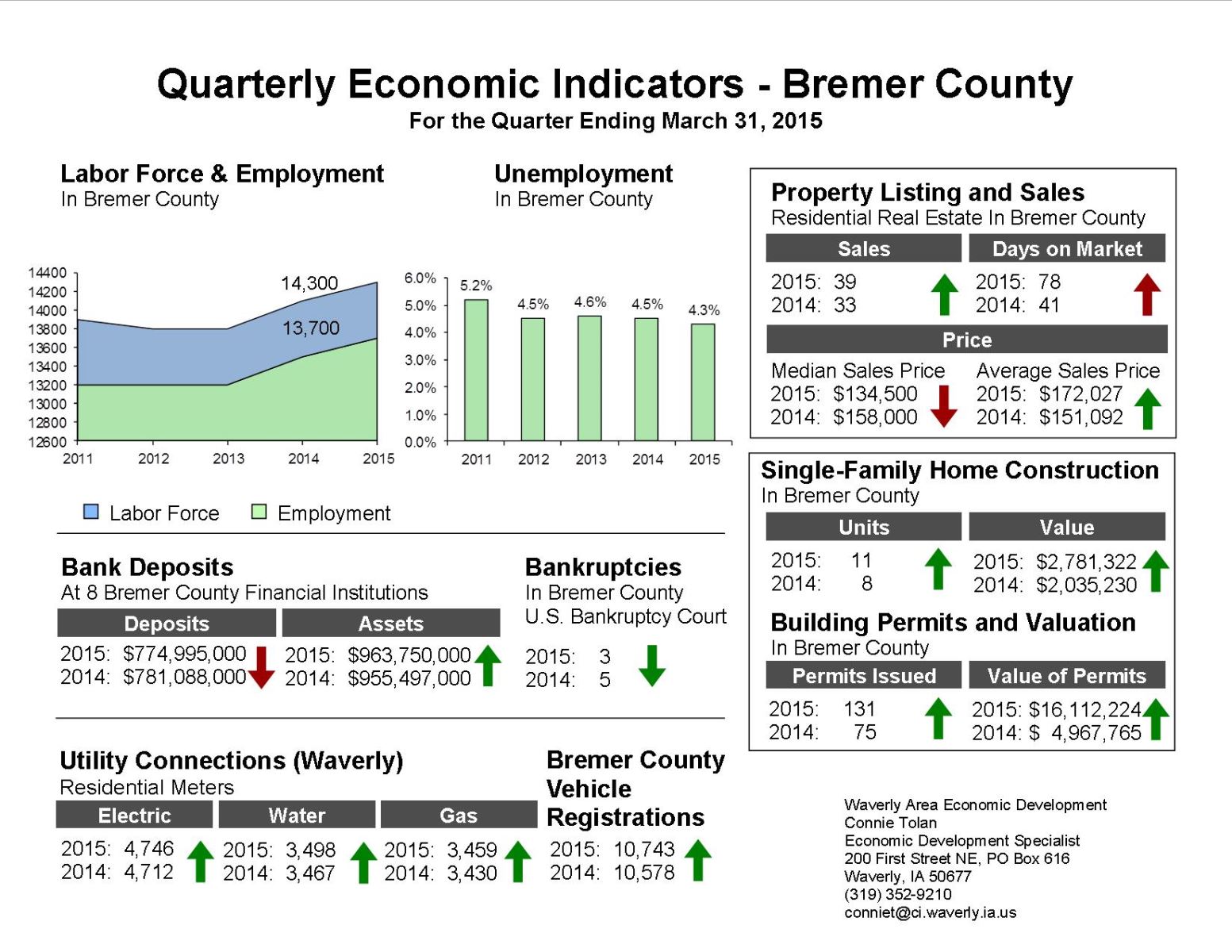

1st Quarter

The first quarter Economic Indicators Report shows strong construction activity, continued strength in employment and growth in bank assets. Vehicle registration, utility connections and bankruptcies also show positive trends.

2014

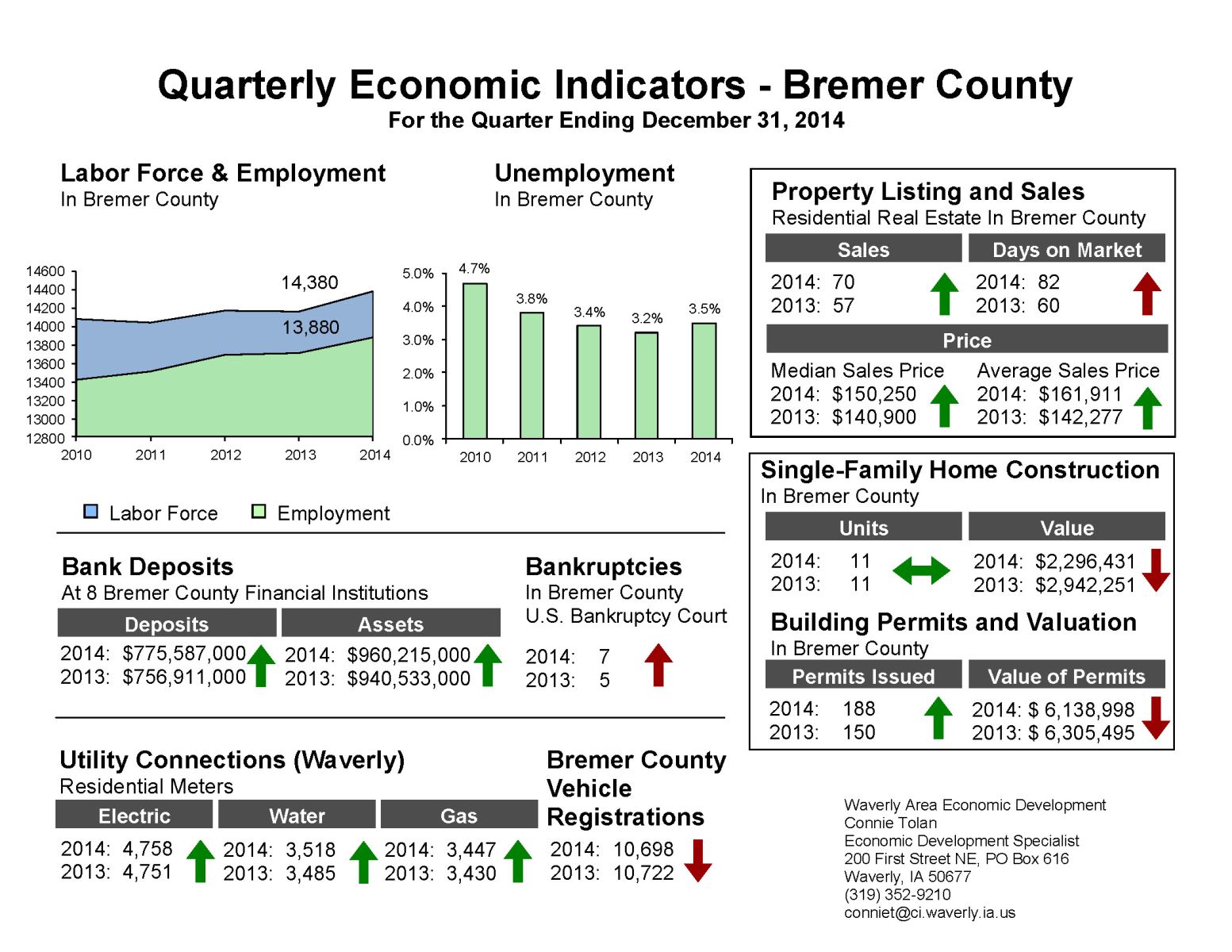

4th Quarter

The year-end Economic Indicators Report shows strong employment figures and continued growth in bank deposits and assets. Home sales and new home construction also continue at a strong pace.

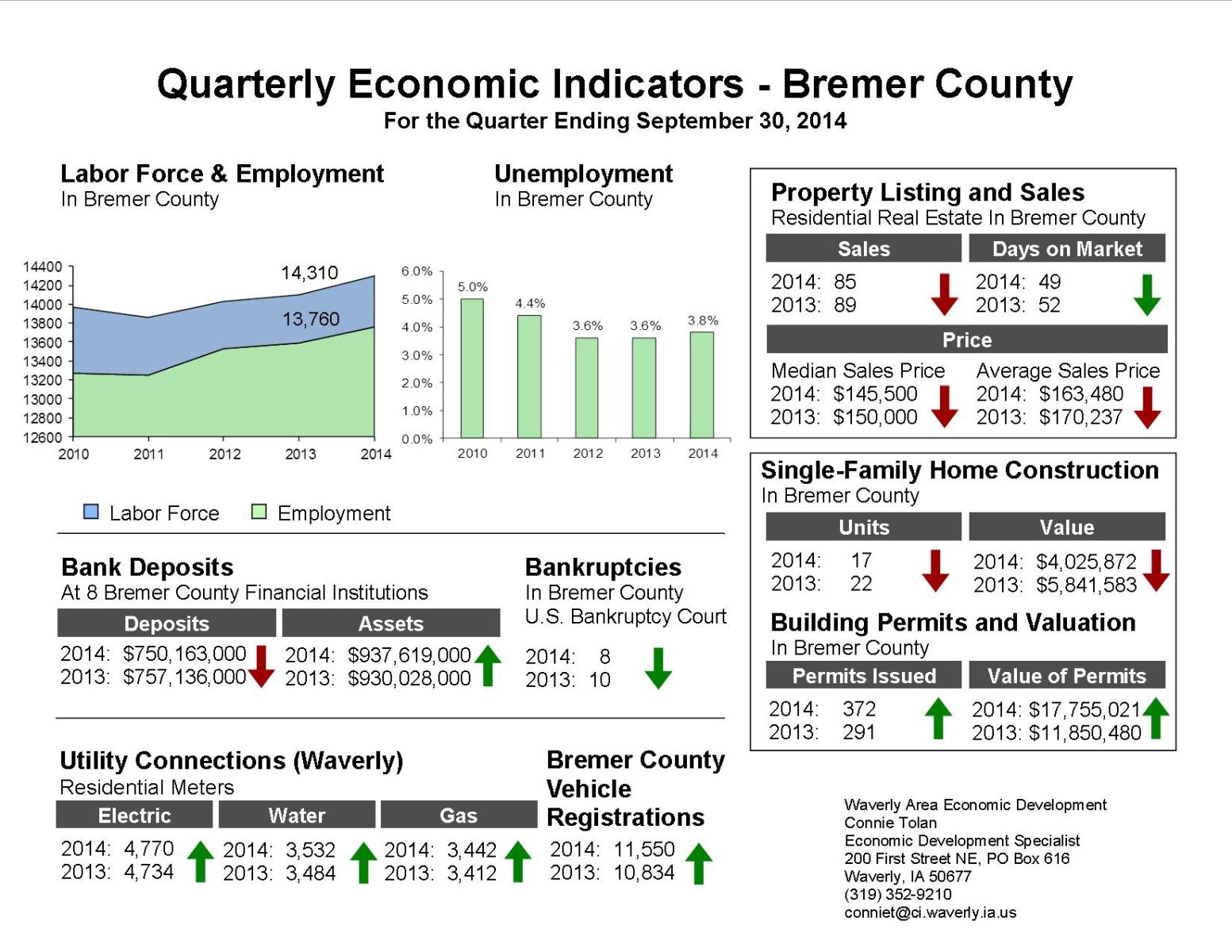

3rd Quarter

Indicators are mixed compared to an exceptionally strong quarter one year ago. Employment remains strong, bank assets continue to grow and construction activity is robust as evidenced by permit and utility connection numbers.

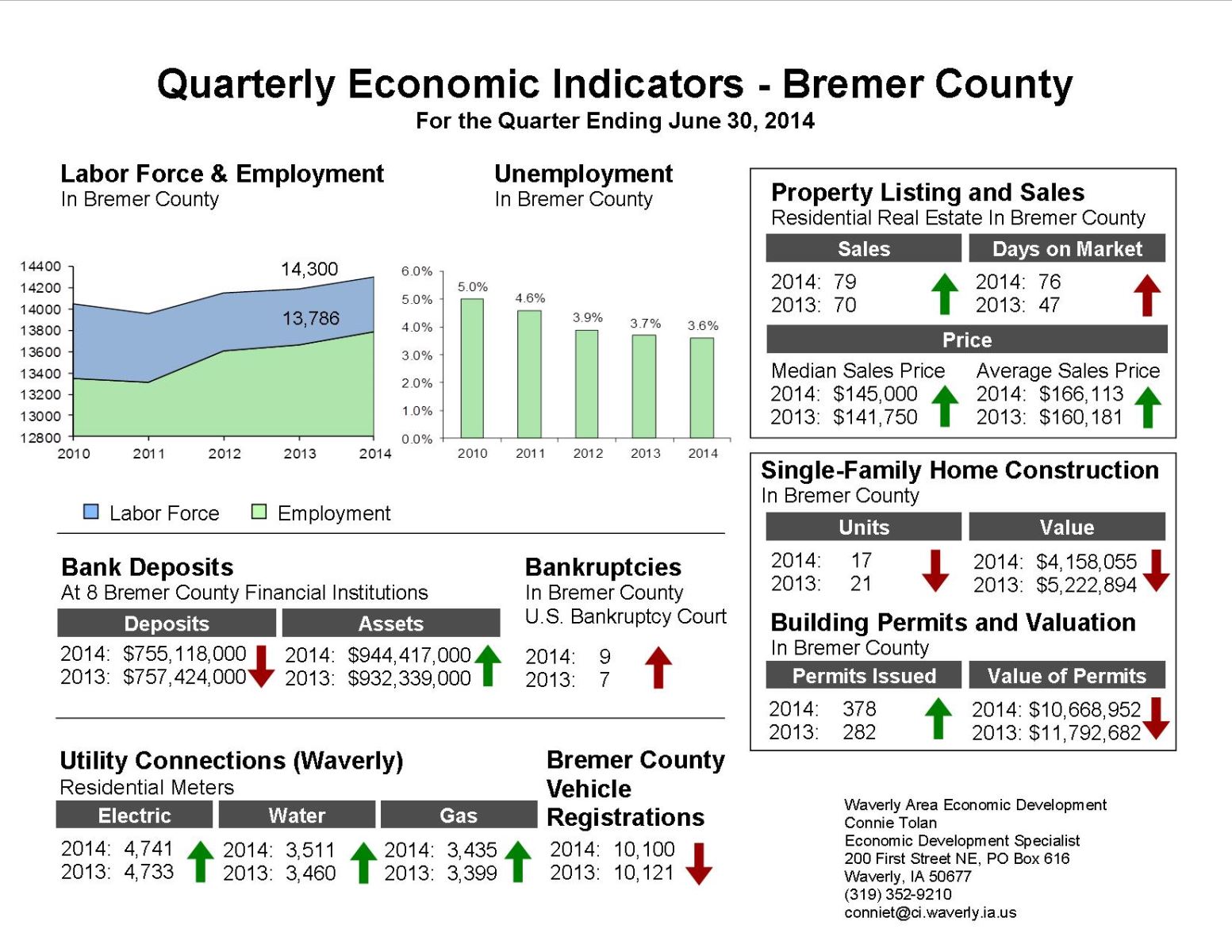

2nd Quarter

Economic Indicators for Bremer County show notable growth in bank assets, positive trends in real estate sales, and continued strength in employment.

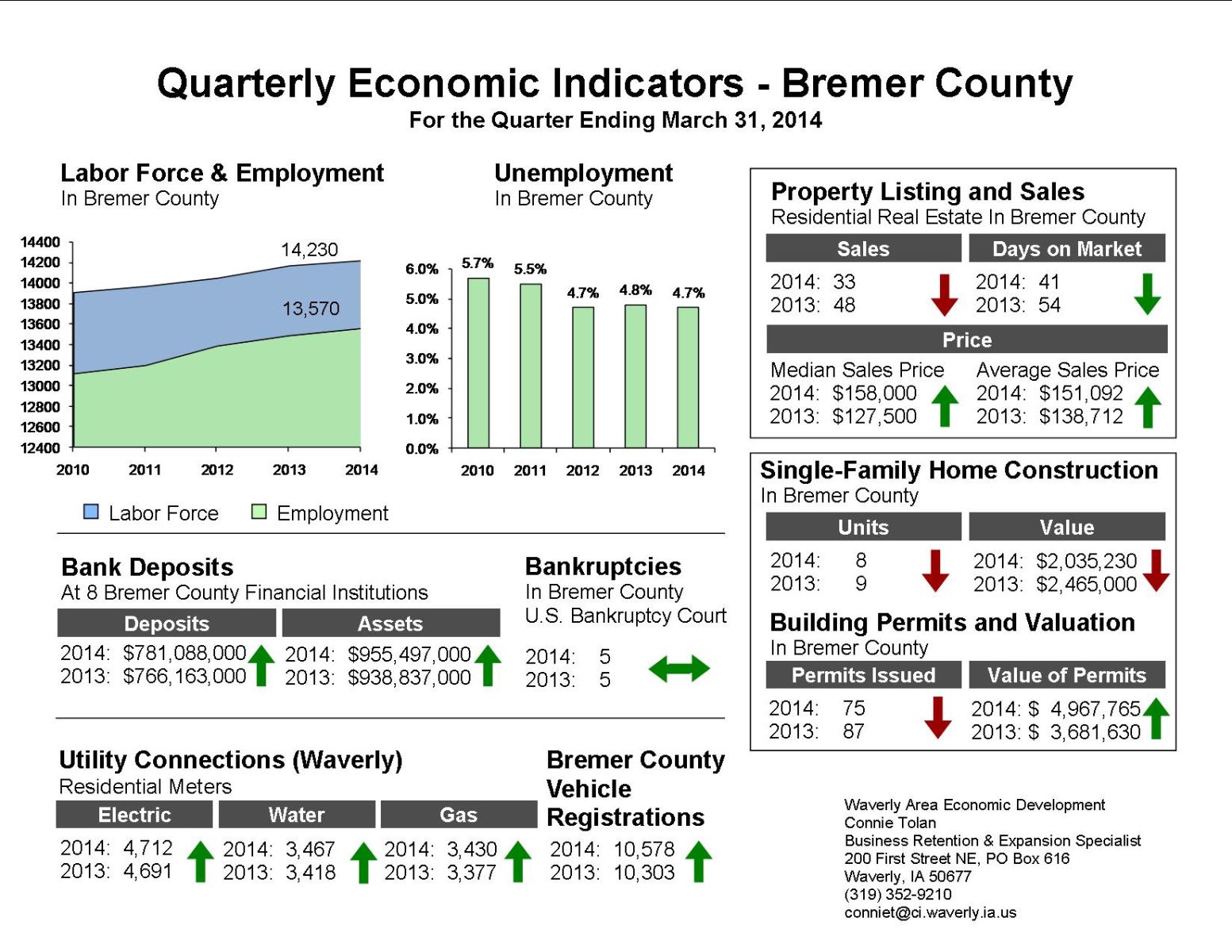

1st Quarter

The 1st Quarer Economic Indicators Report for Bremer County shows positive trends in employment, bank deposits, bank assets, utility connections and vehicle registrations, while real estate and construction figures remained remarkable strong despite harsh winter weather conditions.